COVID-19 Bulletin: November 24

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices hit a 3-month high yesterday on positive vaccine news. Energy prices were higher in early trading today, with the WTI up 1% at $43.50/bbl, Brent up 1% at $46.51/bbl and natural gas 1.6% higher at $2.76/MMBtu.

- Demand for oil is rebounding faster in Asia than Western countries, evidenced by a disparity in prices between pricier Dubai crude, mainly bought by Asian refiners, and lower-cost West Texas Intermediate.

- Houthi rebels launched a cruise missile attack on an Aramco oil storage facility that comprises 10% of the company’s stored oil, causing extensive damage but no injuries.

- With the amount of oil in floating storage falling significantly, tanker owners are seeing falling rates along with prospects of a weak winter season.

- Consulting firm Accenture predicts that consolidation will continue in the oil and gas industry, with 8 to 12 companies controlling half of U.S. production by mid-2021, down from 16 to 17 players today.

- The Oil and Gas Methane Partnership, a consortium of 62 oil and gas companies, pledged to tighten up and expand their reporting on methane emissions.

- An Australia-Singapore solar energy project would combine the world’s largest solar farm, battery and undersea electricity cable to provide 10 gigawatts of power at a hefty price of $16 billion.

Supply Chain

- Several shipping lines have imposed port congestion surcharges on Asian tradelanes due to a shortage of available containers and increased spot rates.

- Port delays are compounded by increasingly stringent inspections from Chinese storage workers looking for COVID-19 infections on frozen food shipments.

- CMA CGM, the world’s fourth-largest container shipping line, reported a 21% increase in third-quarter earnings from the year-ago period alongside stronger e-commerce shipments.

- New technology developed by DHL could slash the time it takes to integrate new robot systems in warehouses by up to 60%, an initial run in Madrid shows.

- With tight freight capacity nationwide and supply constraints with many plastic resins, clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- U.S. COVID-19 hospitalizations approached 86,000 yesterday, the 14th consecutive day of record hospitalizations, while new infections of over 169,000 topped 100,000 for the 20th consecutive day.

- Computer models show the U.S. could see 30,000 more coronavirus fatalities by Christmas.

- New York is opening an emergency surge facility on Staten Island to deal with rising coronavirus patients.

- Greater Los Angeles, the country’s most infected metropolitan area, is again imposing measures to limit businesses and movement after a 4,000-case threshold was met. The governor of California is in quarantine after three of his children were exposed to someone who tested positive for COVID-19.

- Both the Pfizer and Moderna vaccines can cause side effects similar to the symptoms of COVID-19, which could discourage people from taking the second dose required to achieve immunity.

- Moderna’s chief medical officer cautioned about over interpreting test results for its experimental vaccine, warning that those vaccinated might still be capable of carrying and spreading COVID-19.

- Regeneron will begin shipping 30,000 doses of its antibody drug treatment today after receiving emergency approval from U.S. regulators.

- Up to 80% of newly infected people lose their sense of smell, a phenomenon known as “anosmia” that offers clues into how the coronavirus affects the brain.

- Though their initial symptoms may be less severe, young people are seeing a disproportionately high level of “long-haul” effects from COVID-19, where symptoms last months or longer.

- U.S. business activity in November grew at the fastest pace since 2015, with the composite purchasing managers index rising from 56.3 in October to 57.9 this month, well above the reading of 50 indicating growth.

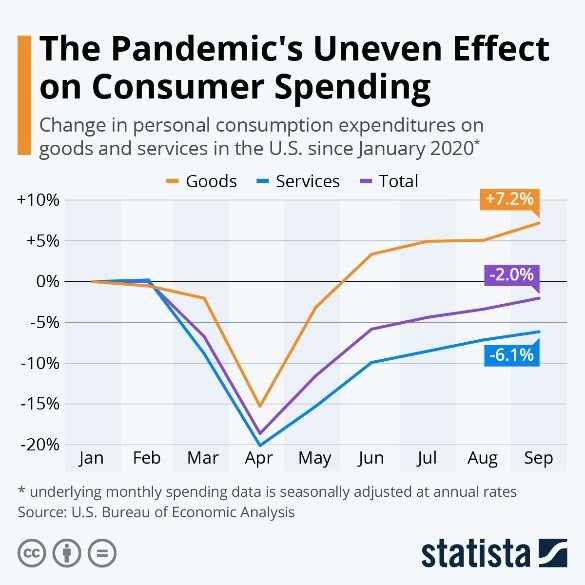

- Spending on goods has bolstered the economy against weak spending in the services sectors:

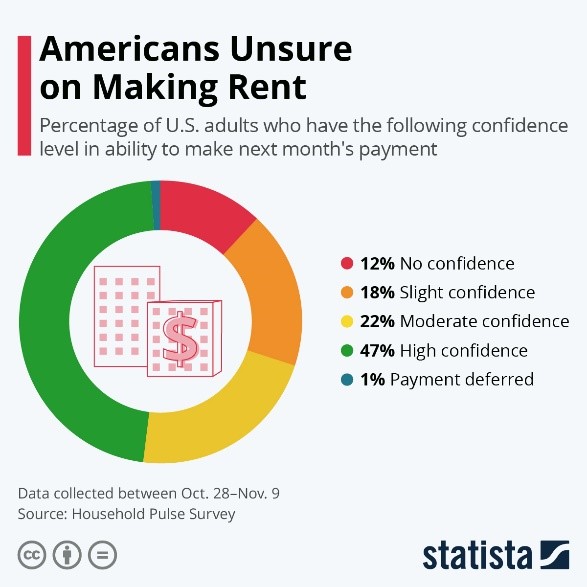

- With federal eviction moratoriums set to expire at year end, nearly 18 million households are behind on their rent or mortgage payments, according to a U.S. Census Bureau Survey, with a third of those expecting to be evicted in coming months.

- Despite CDC warnings against travelling, more than 3 million people took flights over the weekend, the highest rate of the pandemic. Several testing options are available to people before meeting with family members for the holidays.

- Many malls saw crowds over the weekend as holiday shoppers sought to shop ahead of pending lockdowns. The National Retail Association projects holiday spending could rise by as much as 5.2% this year.

- Along with running its own facilities 24 hours a day, Clorox’s addition of 10 third-party manufacturers has not been enough to keep up with a staggering demand for a million packs of cleaning wipes per day.

- There were more than $1 trillion in M&A deals in the third quarter of 2020, up from $762.67 billion in the year-ago period, as dealmakers adapt to online negotiating and due diligence.

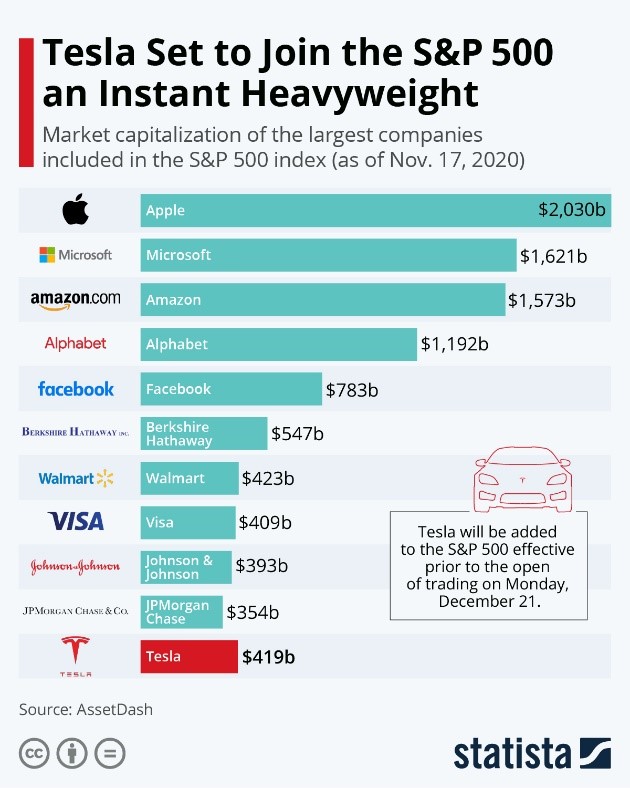

- Electric vehicle maker Tesla is now worth nearly 30% of the auto industry’s total value, making it one of the highest valued companies in the S&P 500 when it is added to the index next month.

- Consumers continued spending on home improvements in the third quarter, with Home Depot reporting a 24.6% jump in same-store sales from a year ago and sales for Lowe’s rising 30%. Digital sales for both retailers nearly doubled year-over-year.

International

- France reported fewer than 5,000 new COVID-19 infections Monday, the lowest count since the end of September and an indication that the country’s second national lockdown is working.

- Italy is the second European country behind the U.K. and the sixth global country to pass 50,000 fatalities from COVID-19.

- Turkey reported its highest daily number of COVID-19 fatalities alongside a spike of 6,713 cases Monday.

- The Saudi government plans to provide free vaccines to all citizens, with an intermediate goal of 70% vaccination by the end of 2021.

- Amidst renewed lockdowns, business sentiment is falling in Germany and France, with 70% of businesses in Germany’s hospitality sector in danger of failing.

- A Hong Kong-to-Singapore “air bubble” that was set to begin flights last weekend has been delayed after a small crop of COVID-19 cases appeared in Hong Kong.

- Dutch students have constructed an electric vehicle entirely from plastic and other waste, with part origination stretching from ocean plastic to household trash. The two-seater can go 137 miles on a single charge.

- Real-world use of plug-in hybrid vehicles could cause significantly more CO2 emissions than advertised, a Brussels advocacy group warns.

- While global emissions of greenhouse gases in 2020 are projected to fall up to 7.5% due to pandemic-induced industrial slowdowns, climate experts warn the reduction will be a mere “blip” downward in an overall trend upward.

Our Operations

- Our latest Founders Series video is a tribute to Joan Holland, co-founder and matriarch of M. Holland, who recently passed away. Watch the video here.

- M. Holland will be closed Thursday and Friday for the Thanksgiving holiday.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.