COVID-19 Bulletin: October 28

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude prices swooned on pandemic fears and reports of rising oil and gasoline stockpiles, with the Brent price falling below $40 early today.

- In mid-day trading, the WTI crude price was down 5.7% at $37.30/bbl and Brent was down 5.0% at $39.19. Natural gas was slightly higher at $3.04/MMBtu.

- Leisure driving, which accounts for 55% of car travel in the U.S. and increased from pandemic lows through September, was down 12% from pre-pandemic levels in October.

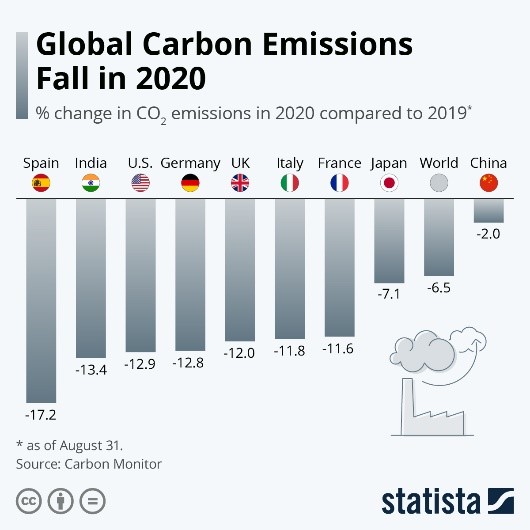

- Conquering climate warming may require not just the end of rising carbon emissions, but a reduction in carbon in the atmosphere, according to a recent study, which projects that revenue from government sponsored carbon reversal programs could generate $1.4 trillion in revenue by 2050.

- One positive result of the pandemic: a drop in global carbon emissions:

Supply Chain

- Zeta is expected to strike New Orleans as a Category 2 hurricane this evening.

- Utility Southern California Edison said its equipment might have started the fires blazing south of Los Angeles that have forced the evacuation of more than 80,000 people.

- UPS reported a nearly 16% rise in revenue in the third quarter on a spike in online parcel deliveries and a hike in international shipments.

- Wearable technology, such as barcode scanners built into employee gloves and bands that fit into trucker driver headsets to manage fatigue, is changing transportation and logistics operations, allowing companies to achieve ever-faster delivery.

- Toymakers Mattel and Hasbro have reported disappointing results despite a surge in product demand during the pandemic due to supply chain disruptions and lower than usual inventories at retail stores.

- Daimler trucks and buses reported a 60% year-over-year increase in incoming net orders in the third quarter, in part due to suppressed demand in the second quarter. Global production and sales of trucks remains below pre-pandemic levels.

- Automakers are shifting their attention from building hydrogen cars to building hydrogen freight trucks. Compared to battery-powered vehicles, the technology is more suited to long-distance traveling and quick refuels.

- With tight freight capacity nationwide and supply constraints with many plastic resins, clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. suffered its fourth highest daily infections yesterday — 73,240. Deaths doubled from Monday to 985.

- Tuesday’s seven-day average for new COVID-19 cases in the U.S. hit an all-time high at 69,967, with cases rising in over 40 states.

- Twenty-nine states have recorded their single-day highs in COVID-19 infections this month.

- Wisconsin set records yesterday for daily COVID-19 infections and deaths, prompting the governor to ask citizens to voluntarily lock down at home.

- COVID-19 hospitalizations have increased 10% in 32 states since last month’s surge of new cases, with New Mexico (+68%), Wyoming (+50%) and Connecticut (+38%) hit the hardest.

- Illinois’ governor imposed new restrictions on parts of Chicago Tuesday, such as no indoor service at bars and restaurants.

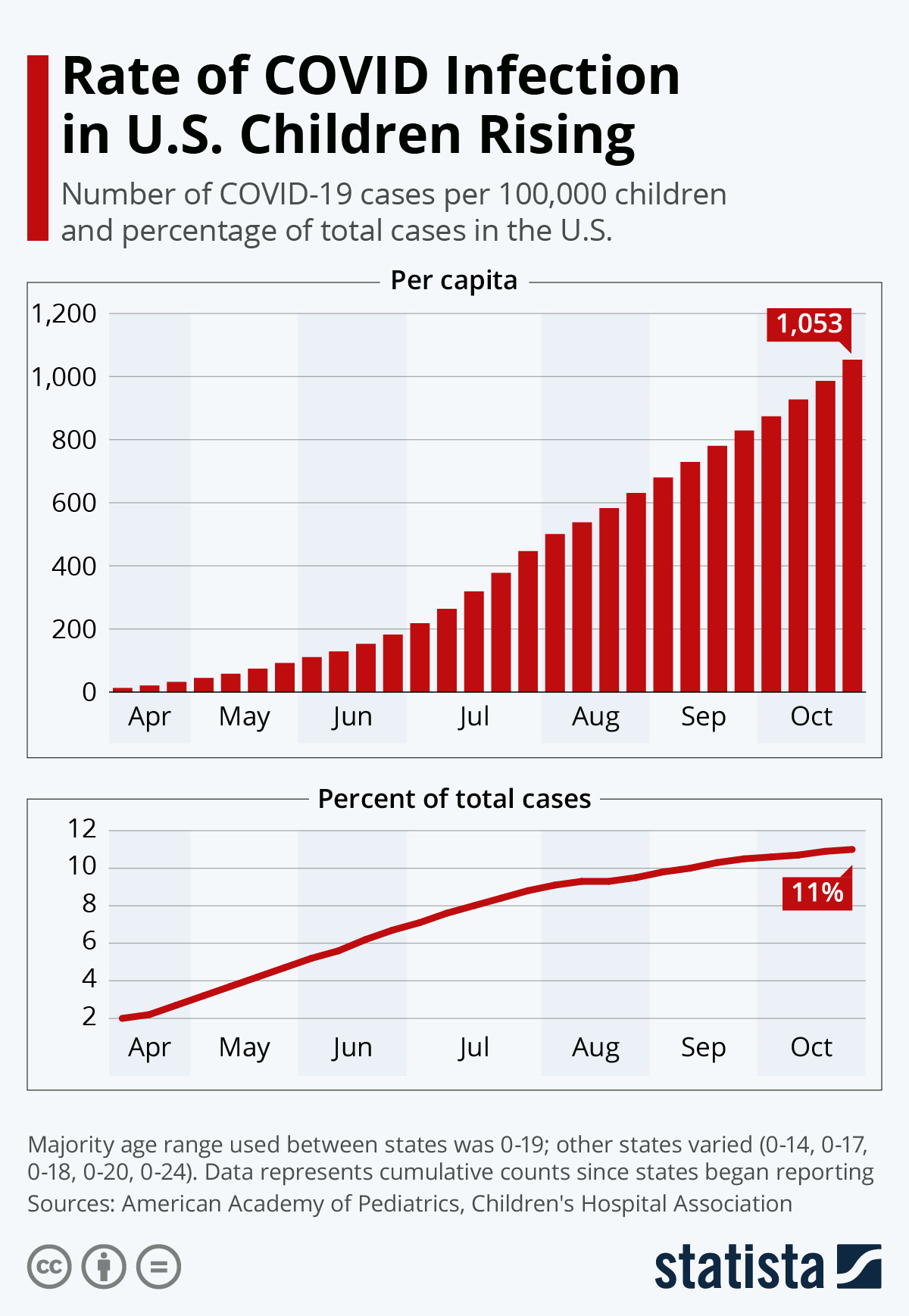

- COVID-19 infection rates are rising among children in the U.S.:

- Almost 100 federal air marshals have been infected with COVID-19. While exact numbers are uncertain, several of those infected likely contracted the virus in their time spent at airports and on planes.

- As a precautionary measure, New York’s governor added California to a list of 39 other states whose residents must quarantine for 14 days after traveling to the state, effectively discouraging 95% of the country from visiting New York state. Meanwhile, people who do not wear a mask at New York airports and Manhattan bus terminals and railways face a new $50 fine.

- California, Washington, Oregon and Nevada have joined in a plan to review any federally approved COVID-19 vaccine before distributing it to their residents.

- Pfizer executives said 40 million doses of a COVID-19 vaccine could be distributed in the U.S. if clinical testing and regulatory hurdles proceed as expected. Executives expressed hope that a vaccine could be available before year end.

- The federal government will pay $375 million for 300,000 vials of Eli Lilly’s experimental antibody treatment for COVID-19.

- A vast majority of Americans are wearing face masks regularly, a new report from the CDC says.

- Shipping giant Maersk announced a partnership with drug manufacturer Covaxx to distribute its COVID-19 vaccine that is currently in Phase 1 of clinical trials.

- A new study finds that the immune systems of some COVID-19 survivors are creating “autoantibodies” that turn on the body and attack healthy cells, causing debilitating symptoms similar to lupus and rheumatoid arthritis.

- More Americans are getting flu shots than ever before, evidenced by record numbers of shots given out by pharmacies in CVS and Walgreens. Health officials welcome the trend, which could help avoid a “twindemic” of the flu and COVID-19 over the winter.

- Economic bellwether Caterpillar beat analyst estimates in the third quarter, reporting a 54% drop in adjusted earnings year over year on a 29% drop in revenues.

- Fiat Chrysler surprised analysts by reporting record earnings in the third quarter as production returned to pre-pandemic levels.

- 3M beat analyst earnings estimates in the third quarter on continued strong demand for face masks and healthcare products.

- Raytheon is cutting nearly 20,000 employees and contractors in response to the contraction of the aerospace industry and will reduce its global office footprint by 25%.

- Home prices were up 5.7% year over year in August, according to an S&P index.

- Prolonged home working and schooling have shifted consumer demand from cleaning supplies and staples early in the pandemic to furniture, cooking supplies and sporting goods, including bicycles.

- A rise in home cooking during the pandemic has led to shortages and rising prices for spices.

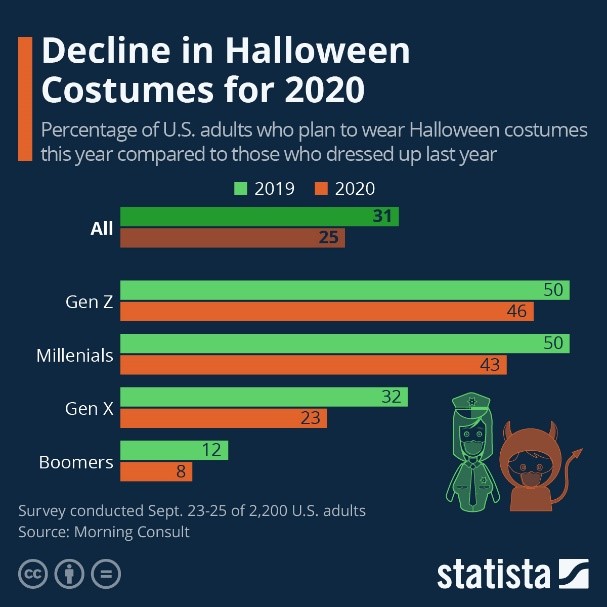

- Halloween spending is expected to dive this year due to the pandemic:

- Six months into the pandemic, the unemployment rate for Hispanic female domestic workers remains four times that of pre-pandemic levels, indicating the continued financial struggle facing domestic workers.

- Consumer goods company Proctor & Gamble approved a resolution to address deforestation and forest degradation in its supply chain after a shareholder proposal received 67% of votes in mid-October.

- While the world champion L.A. Lakers were protected in the NBA playoff “bubble,” its celebrating fans likely contributed to the nearly doubling of daily COVID-19 infections in Los Angeles since the team won the NBA title.

- The Los Angeles Dodgers won the World Series, sans infield star Justin Turner, who was pulled from the game in the 8th inning after testing positive for COVID-19.

International

- Yesterday, the U.K. and France recorded their highest COVID-19 death rates since April and May, respectively. France’s seven-day average of new cases increased by 50% over the past week.

- The chancellor of Germany will propose new national restrictions to state leaders today, as COVID-19 infections are on track to double every seven days and could reach 30,000 next week.

- The Italian government will give aid to businesses after announcing new hours and operations restrictions earlier this month.

- Facing a 22% increase in COVID-19 infections in the past week, the Netherlands government indicated that lockdown restrictions instituted two weeks ago will remain in place into December.

- European governments are recruiting laid off service workers and deploying the military to help shore up short-handed health care staffing in anticipation of rising hospitalization rates.

- Turkey’s government issued an order today barring healthcare workers from resigning or retiring as it battles a surge in COVID-19 hospitalizations. The country ceased publishing confirmed case data in July.

- China’s economic recovery showed signs of easing in October, with sentiments among small businesses turning more pessimistic and housing sales softening.

- Stock markets in Europe fell to a five-month low on fears of spiking COVID-19 infections and the risk of looming lockdowns.

- Risks of renewed lockdowns globally coupled with the suspension of stimulus talks in Washington are creating volatility in currency markets, with both the U.S. dollar and euro weakening yesterday.

- Canada’s central bank is expected to indicate it will keep the overnight interest rate near zero for years to come when it presents its monetary policy report today.

- Turkey’s recent interest rate hikes have failed to bolster its collapsing currency, forcing the government to raise its consumer inflation projections to 12.1% for the year, up 3 percentage points from earlier projections. The Turkish lira hit a record low against the U.S. dollar after the announcement.

- India’s “Animal Spirits” economic indicators showed an improvement in business activity in September, but the nation’s central bank attributed the uptick to pent up demand, and GDP is expected to show a 10% contraction for the recent quarter.

- Manufacturing output in Singapore soared almost 25% in September compared to a year earlier, thanks in part to increased pharmaceutical and electronics production. However, Singapore’s monetary authority warned that the nation’s economic downturn will be deeper and more prolonged than previous recessions.

- Russia applied to the World Health Organization for approval of its COVID-19 vaccine, Sputnik V. The country approved the vaccine internally before large-scale clinical trials were completed.

- London’s Heathrow Airport surrendered its status as Europe’s largest to France’s Charles de Gaulle Airport due in part to the U.K.’s strict quarantine requirements for arriving travelers.

Our Operations

- Reminder: Daylight saving time takes effect this Sunday, November 1, at 2:00 a.m.

- Global Healthcare Manager Josh Blackmore will be a featured speaker on Thursday, October 29 at 10:00 a.m. ET during the Plastics in Healthcare Virtual Edition, sponsored by Plastics News. The title of his talk: Applying the Lessons from the First Wave of COVID-19 to Successfully Navigate the Second.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.