COVID-19 Bulletin: September 22

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Energy prices fell yesterday, with the WTI crude price falling 4% to below $40 and natural gas dropping over 10% to below $2/MMBtu on a sour demand outlook.

- Crude prices were higher in early trading today, with the WTI at $39.60/bbl and Brent at $41.95/bbl.

- The natural gas price was up at $1.88/MMBtu.

- Daily deliveries of natural gas to industry fell 25% from January to June, with June deliveries still 4.6% below June of 2019, according to the Energy Information Administration.

- Many oil-producing countries face mounting challenges with a growing debt load.

- Royal Dutch Shell announced Project Reshape, aimed at cutting operating costs in its downstream operations by 30%-40% as it shifts its focus toward renewable energy sources. The cuts are on top of $4 billion in previously announced expense cuts due to the pandemic.

Supply Chain

- Tropical storm Beta made landfall in Texas late yesterday, delivering heavy rainfall as it travels along the Gulf Coast.

- California’s Bobcat wildfire near Los Angeles might not be tamed until the end of October.

- Wary insurance companies are curtailing trade credit insurance used to facilitate global trade, posing additional risk to U.S. supply chains and the economic recovery.

- Smart packaging is an increasingly important bulwark against security risks in more digitized supply chains.

- Trucking capacity remains tight throughout the U.S., and spot pricing remains elevated.

- Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

Markets

- There were 52,070 new COVID-19 infections in the U.S. yesterday with 356 fatalities. The U.S. death toll topped 200,000 today.

- COVID-19 infections are trending higher in 33 states today.

- The Congressional Budget Office downgraded its long-term outlook for the economy due to the pandemic and recovery spending, predicting an average growth rate of 1.2% over the next 30 years, down from 2.6% since 2000, and projecting national debt will soar to almost twice GDP.

- The head of the Federal Reserve, which has limited power to rescue businesses, called on Congress to provide aid to struggling sectors as hopes fade for a phase 4 federal rescue package before November’s election.

- The Federal Reserve said median household income in the U.S. hit a record high in the second quarter due in part to soaring stock markets, with most of the gain accruing to affluent households.

- The CDC removed guidance on its website posted on Friday saying COVID-19 is spread through airborne transmission, creating confusion about its recommended 6-foot social distancing advice.

- A shortage of reagents for COVID-19 test kits is forcing a curtailment of testing in many parts of the country.

- Pine-Sol was approved by the EPA to kill COVID-19 contagions.

- Office furniture manufacturer Herman Miller reported a 300% increase in home office sales and a 257% rise in online orders in announcing strong quarterly results last week.

- The Detroit auto show, which was postponed for a year to June 2021, has been rescheduled a second time to September 2021.

- Volkswagen, the world’s largest carmaker, is considering selling its Bugatti luxury car brand in a move that could portend a further strategic review of its portfolio as it shifts toward electric vehicles.

- Tesla is expected to announce a battery that can deliver $100/kilowatt-hour, considered the point of cost parity with internal combustion alternatives.

- Rolls-Royce said it will have an electric vehicle this decade as at least 20 major cities globally plan to ban internal combustion engines.

- A bill introduced in Michigan would mandate that Rivian and other electric vehicle companies sell their cars through dealerships, leaving Tesla as the only company permitted to sell directly in the state.

- HP introduced its first laptop computer made with post-consumer and ocean-bound recycled plastics.

- The bricks-and-mortar fitness industry has been among the pandemic’s biggest losers; gyms have lost more than $10 billion this year and 90% of employees were laid off during the pandemic.

- Gym manager LA Fitness is considering financing alternatives as its lenders organize in advance of the October 15 expiration of a forbearance agreement.

- Sixty-two-year-old Sizzler USA, a pioneer in casual dining with 107 restaurants, filed for bankruptcy due to the pandemic’s impact on sales.

- The cruise industry announced planned protocols as it seeks to convince regulators and passengers that it will be safe to resume sailings when its self-imposed shutdown expires at the end of October.

- More colleges are canceling spring break to discourage the spread of COVID-19.

- The NFL’s Las Vegas Raiders debuted the team’s new $2 billion desert stadium, which took three years to build, on yesterday’s Monday Night Football broadcast, but no fans were in the stands due to the pandemic.

International

- Surging COVID-19 infections in Europe sent global stock markets into retreat and prompted a return of government restrictions:

- The U.K. government urged people to return to working at home where possible and is expected to impose renewed lockdown restrictions, including early closing of bars and restaurants. U.K. COVID-19 cases have been doubling every week recently.

- Italy mandated testing for travelers entering from France as cases, hospitalizations and fatalities in France rise.

- Madrid, which recorded more than 12,000 COVID-19 infections over the weekend, ordered residents to restrict activity “to the maximum” and enlisted the police and army to man checkpoints in the city.

- After reducing COVID-19 cases to zero in May, Croatia is experiencing a surge in cases after reopening to tourism. Bar and restaurant owners staged a brief work stoppage in an appeal to the government for economic help.

- Daily COVID-19 cases in India fell to 75,083 yesterday after the country suffered over 630,000 cases in the past week.

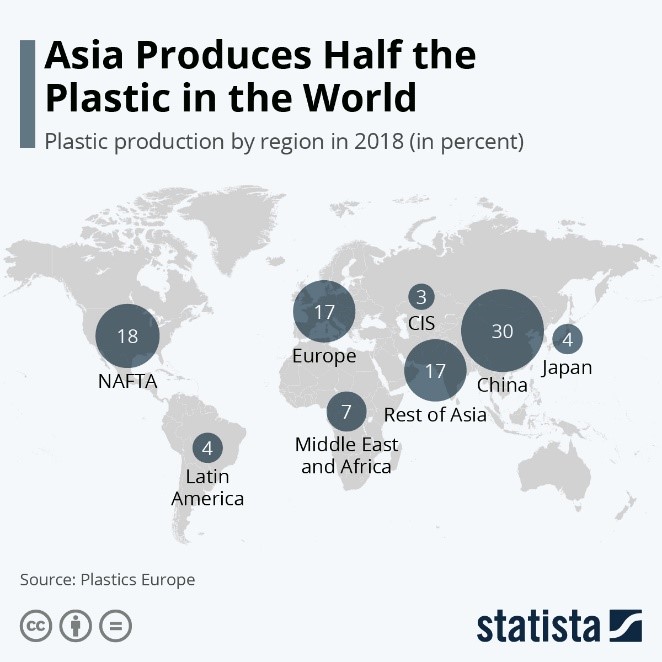

- Asia produces over half the world’s plastics …

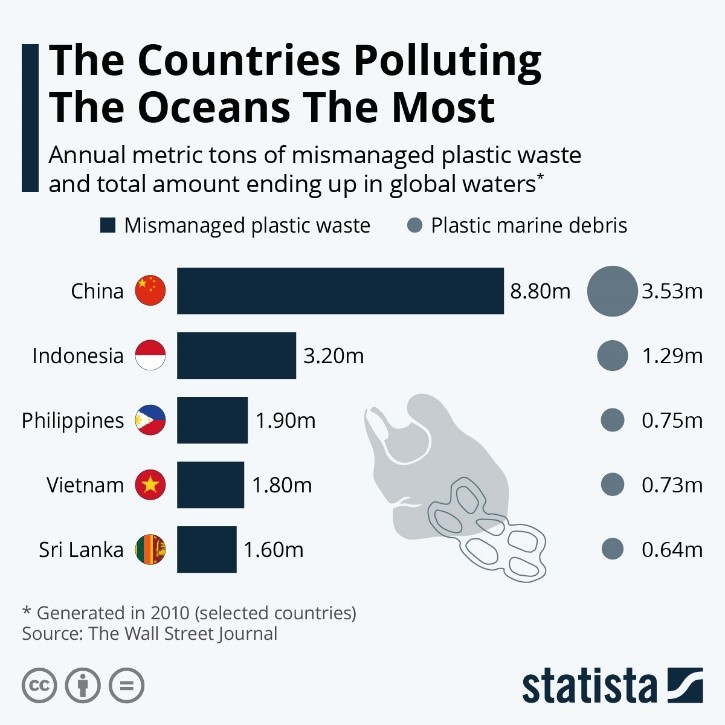

- …and generates the most ocean pollution:

Our Operations

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.