COVID-19 Bulletin: September 18

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude prices were modestly lower in early trading today, with the WTI at $40.68/bbl and Brent at $42.92/bbl.

- The natural gas price was lower at $2.01/MMBtu.

- The U.S. remained the world’s top oil producer in July, pumping more than 11 million barrels per day, outpacing Russia and Saudi Arabia.

- Both OPEC and the International Energy Agency reduced their demand projections this week at the same time supply is rising.

- Many of the 3.2 million abandoned oil and gas wells in the U.S. continue to leak methane, a more powerful greenhouse gas than carbon dioxide. Some oil and gas giants are partnering with an environmental think tank to track methane emissions in the Permian Basin.

- Circle K stores in Canada and the western U.S. will soon feature e-vehicle charging stations.

- Buyout firm Apollo Global Management is considering an acquisition of Covestro.

Supply Chain

- Hurricane Teddy strengthened to a Category 4 storm in the Atlantic and could strike New England next week. Separately, a tropical depression in the Gulf of Mexico could become the next named storm.

- It appears that downed power lines sparked a number of the massive fires still burning in Oregon, posing liability risk to local utilities.

- Smoke from wildfires can amplify the effects of COVID-19, posing a second layer of risk to firefighters and citizens in the West and Northwest.

- Twenty percent of the world’s 1.6 million seafarers remain stranded on vessels, some for more than a year, with many facing labor violations that threaten their safety and global supply chains.

- Rail volumes were down 9.9% year over year last week.

- UPS plans to trim its non-operating executive management with buyout offers as it recruits 100,000 seasonal workers for the holiday season.

- TerraCycle’s Loop reusable/refillable packaging platform is expanding to 48 states. The company has signed up more than 100,000 customers and features 80 brands.

- Trucking capacity remains tight throughout the U.S., and spot pricing remains elevated.

- Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

Markets

- COVID-19 infections rose to 44,360 yesterday from 38,410 the day before. There were 870 deaths, compared with 1,014 reported on Wednesday.

- COVID-19 infection rates are trending higher in 38 states this week; there were 31 trending higher as of Wednesday.

- New studies from the CDC indicate pregnant women who contract COVID-19 are at greater risk of premature and still births.

- A shortage of teachers forced New York City to delay for the second time the reopening of schools, which were scheduled to resume on-site instruction on Monday.

- A poll in American cities indicates 1 in 5 households have missed needed healthcare because of fear of COVID-19, backlogs at medical facilities or other pandemic-related reasons.

- The nation’s current account deficit jumped a higher-than-expected 53% in the second quarter to over $170 billion, the highest level in 12 years, as the fall in exports of goods and services more than offset a decline in imports.

- After digesting Federal Reserve statements after its monthly meeting on Wednesday, global equity markets sank yesterday on disappointment that the central bank announced no plans for further quantitative easing to stimulate the economy.

- The Federal Reserve plans another round of stress tests for major banks to gauge their ability to survive a second coronavirus event.

- The White House announced $13 billion in federal aid to farmers to counter the impact of the pandemic.

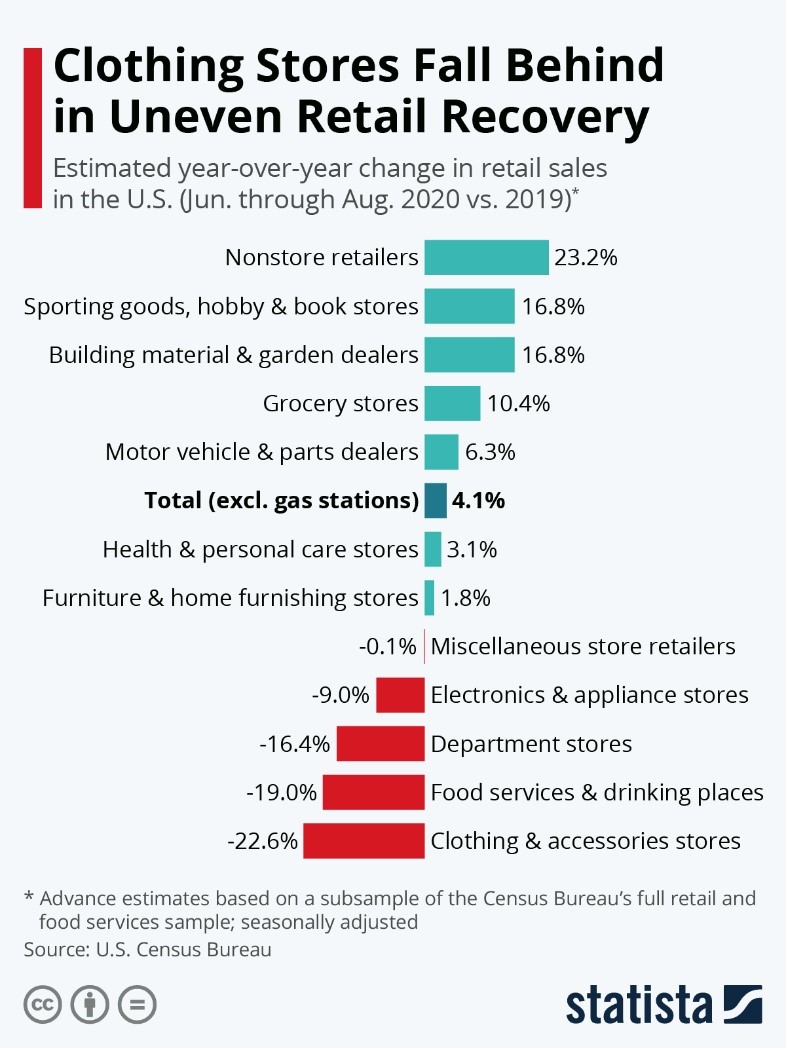

- The pandemic has had an asymmetrical impact on consumer markets:

- The nation’s major airlines met with the White House to appeal for $25 billion in additional aid. A moratorium on layoffs in the industry expires October 1.

- Carnival Cruise Line is selling 18 vessels and canceling voyages for many others until 2021 and 2022.

- With the cruise industry largely idled, enterprising tour companies are organizing tours for cruise aficionados to see anchored vessels.

- Ford plans to build a new, $700 million plant in Dearborn, Michigan, to manufacture its all-electric F-150 truck.

- An expected wave of auto-loan defaults has not yet occurred since CARES Act stimulus programs ended in August.

- Kraft Heinz said in its second annual ESG report that it is on track to convert 100% of its packaging to recyclable, reusable or compostable alternatives by 2025.

- Golfers played 10 million more rounds in July of this year, a 20% increase year over year, as the sport has emerged as among the most pandemic friendly.

- The National Hockey League has approved its first helmet with a 3D printed liner.

- LSU’s football coach drew attention in announcing that “most” of his players had contracted COVID-19, an assertion he later scaled back but not before raising concerns about the resumption of college sports.

International

- COVID-19 cases globally surpassed 30 million yesterday.

- Healthcare workers make up 1 in 7 COVID-19 infections globally, according to the World Health Organization.

- India, with among the highest COVID-19 infection rates globally, will experience a 14.8% economic contraction this year, according to Goldman Sachs.

- Spain’s central bank said the economy could shrink as much as 12.6% this year, and unemployment is likely to remain above 20% through 2022.

- Russia’s central bank, constrained by a weakening currency, held interest rates steady at 4.25% yesterday but said it will consider rate cuts in the future.

- China banned another food importer after detecting COVID-19 pathogen on packaging of seafood from Indonesia.

- The U.K.’s health minister would not rule out a second national lockdown as the nation confronts a surge in new COVID-19 infections.

Our Operations

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.