COVID-19 Bulletin: August 27

Good Afternoon,

More news relevant to the plastics industry:

Hurricane Laura

- Hurricane Laura slammed into the coast of Louisiana at 2:00 a.m. today with Category 4 winds of 150 miles an hour, the strongest storm to strike the state in more than a century.

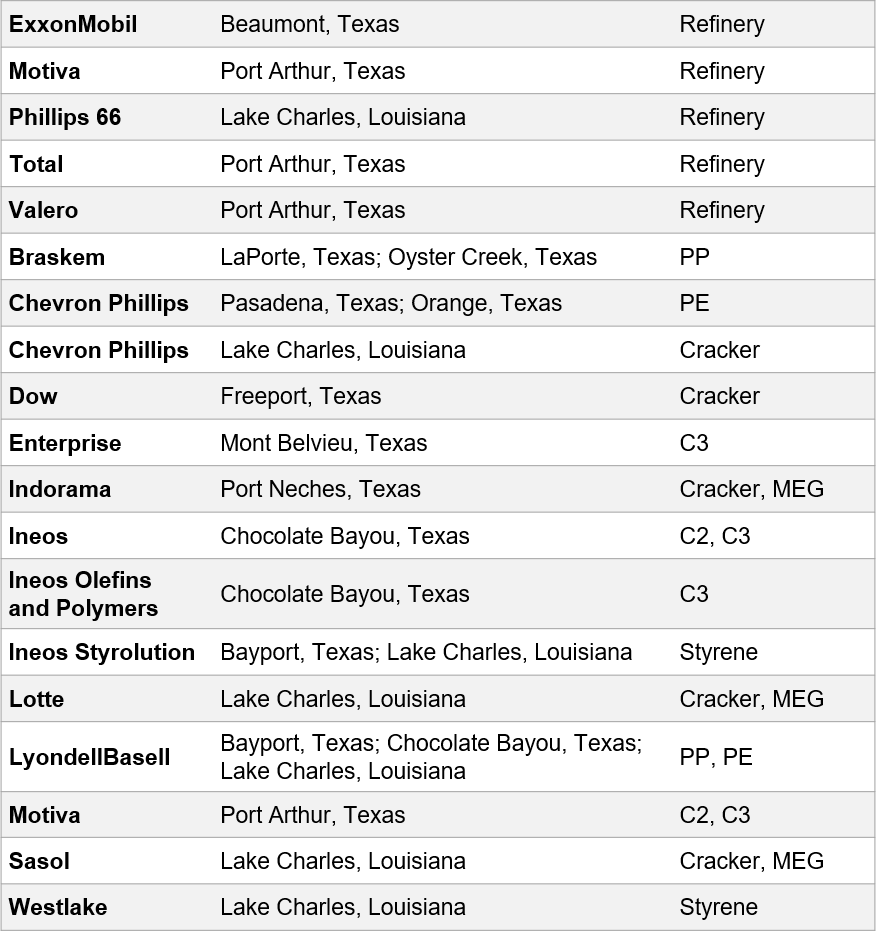

- The storm struck near Lake Charles, the state’s fifth largest city and home to some major petrochemical facilities.

- The area dodged what was expected to be a historic storm surge.

- Over 20% of the nation’s refining capacity and up to half of its ethylene capacity could be impacted by the storm.

- Petrochemicals companies shuttered facilities from Houston to Lake Charles:

- Ports in the region remain closed today.

- Our Logistics team reports that rail traffic and bulk truck traffic in the region has been curtailed.

- Our Gold Standard logistics partners in the region are closed today.

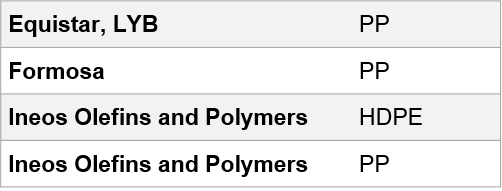

- The following suppliers have issued force majeure notices:

Supply

- Crude prices were lower in early trading today, with the WTI at $42.80/bbl and Brent at $44.92/bbl.

- While global oil demand is back to nearly 90% of pre-pandemic levels, it is expected to wane with the prolonged slump in air travel and the extension of work-from-home schedules.

- Saudi Arabia’s revenues from oil exports plunged 54.8% year over year in June.

- Despite the collapse of oil revenue and the pandemic, Saudi Arabia is proceeding to build several new cities in an effort to diversify its economy beyond energy.

Supply Chain

- Wildfires in California are largely suppressed, despite 50 new fires yesterday that brought the total number to more than 700 since the crisis began.

- While dry van capacity is improving, the bulk trucking sector has worsened, with rising manufacturing activity and low inventories expanding regional tightness into a national capacity shortfall. Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

- Freight pricing continues to rise due to capacity constraints and the higher cost of operations due to the pandemic.

Markets

- New COVID-19 infections rose to 44,109 yesterday with 1,222 deaths reported.

- Fourteen states have experienced rising COVID-19 infections over the past two weeks.

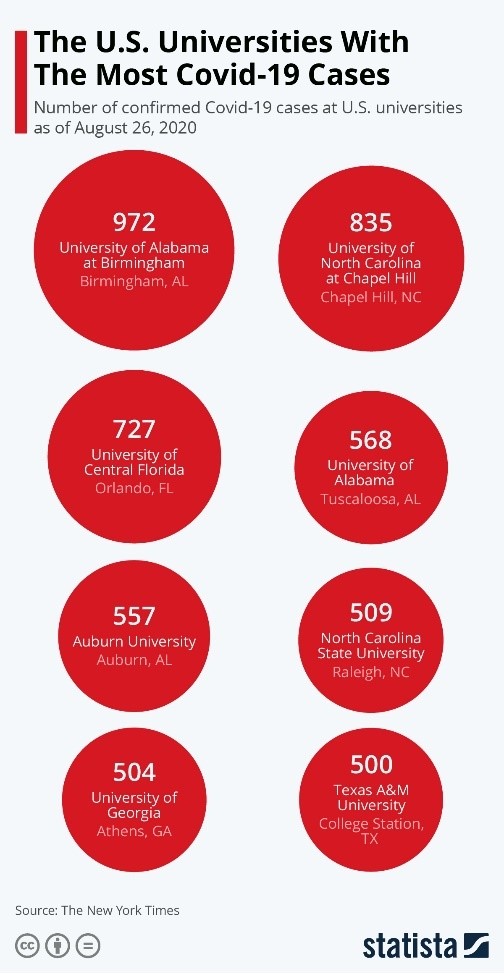

- Universities are a hotbed of new infections:

- The Federal Reserve, announcing a strategy change, said it will no longer raise interest rates preemptively, signaling that the low rate environment may persist for years.

- One million people filed for first-time unemployment benefits last week, down from the prior week and in line with economist expectations.

- Despite high unemployment, restaurants are struggling with a worker shortage as COVID-19 fears dissuade people from front-line service jobs.

- Durable goods orders rose a higher-than-expected 11.2% in July compared with June, the third monthly gain, led by a 22% increase in automobile sales.

- With negotiations on further relief legislation stalled in Washington, the White House is considering executive action to assist airlines after American Airlines and Delta Air Lines announced major layoffs for October.

- White House and congressional leaders will meet today in an attempt to revive stalled stimulus negotiations.

- The CDC altered previous guidance and indicated testing is unnecessary for COVID-19 patients who are asymptomatic, perplexing health experts.

- The FDA gave emergency use authorization for Abbott Lab’s $5 rapid test system that can deliver results in 15 minutes.

- Moderna said Phase 1 testing results show its experimental vaccine prompted an immune response in older adults as well as young people.

- Many companies, citing privacy laws, are mandating that employees not discuss COVID-19 infections in their workplace with fellow employees, but such laws don’t apply to safety matters.

- Leading mall landlord Simon Property Group is becoming a leading retailer, buying distressed tenants Brooks Brothers and Lucky Brand Jeans and bidding on JCPenney.

- Retail bankruptcies are expected to force many of the nation’s 300 class B malls out of business.

- Ford has ordered its 30,000 staffers who work at or near its Dearborn headquarters to collect and clear possessions from their offices as the company plans for a more remote workforce permanently. More than 80% of its workers surveyed say they would like to continue working remotely at least part time.

- Roadside hotels experienced a 44.4% drop in revenue in the second quarter, compared with a larger 80.6% drop for luxury hotels.

International

- Mexico’s GDP plunged 18.7% year over year in the second quarter, marking the country’s worst contraction since the Great Depression.

- U.S. Customs and Border Protection closed lanes at ports of entry with Mexico and increased secondary checks to block non-essential crossings in an effort to slow COVID-19 spread, causing long waits.

- With schools closed due to COVID-19 and much of the country without internet, Mexico has turned to television as its primary classroom during the pandemic.

- Canada is enjoying a sharp rebound after suffering what is expected to be a 40% contraction in the second quarter when GDP figures are announced tomorrow.

- South Korea suffered the highest daily infection rate since March, prompting debate on whether social distancing restrictions should be raised to Level 3, with more than half of citizens advocating for tighter restrictions.

- The head of the U.K.’s Chambers of Commerce warned that the country faces “the second leg of a hurricane” from the pandemic and economic crisis and urged the government to extend stimulus efforts.

- Air passenger arrivals in the U.K. fell 97% year over year in the second quarter.

Our Operations

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Lindy Holland.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.