COVID-19 Bulletin: August 24

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Crude prices were modestly higher in mid-day trading, with the WTI at $42.39/bbl and Brent at $44.76/bbl.

- More than half of the rigs in the Gulf of Mexico have suspended production and some have evacuated workers with the approach of Hurricane Marco and Tropical Storm Laura.

- The Baker Hughes count of active drilling rigs rose last week for the first time since March to 254, up 10 from the prior week’s historic low.

- Gulf of Mexico driller Arena Energy filed for bankruptcy with plans to sell its assets to a private equity group.

- Some major oil companies are investing in forests, not to harvest trees but to leave them standing in order to take advantage of carbon-tax credits while reaping the public relations benefit.

- Norwegian insurance giant Storebrand ASA has divested stakes in Chevron and Exxon and is exiting its coal investments as part of its climate policy.

- Three of five seats on Harvard University’s Board of Overseers were won by activists advocating for the divestment of fossil fuel investments by the school’s endowment fund, among the nation’s largest.

- Improving demand and supply disruptions at several production facilities have made polypropylene especially tight in North America with producers requesting accurate forecasts and extended lead times.

Supply Chain

- Hurricane Marco and Tropical Storm Laura are expected to make landfall along the Louisiana/Texas coast, potentially marking the first time in recorded history two severe storms struck the same coast at the same time.

- Firefighters in Northern California struggled to control three major wildfires, including two of the largest in state history, as the weather forecast called for high winds and potential lightning storms.

- Schools are encountering monthslong waits for badly needed laptop computers due to a surge in demand and supply chain disruptions caused by U.S. sanctions on China.

- The decades-long pursuit of lean manufacturing and just-in-time inventory continues to create supply shortages for essentials such as paper towels during the pandemic.

- Autonomous trucking is quietly taking root, with several companies testing autonomous vehicles on the road with safety operators in the cabs.

- While dry van capacity is improving, the bulk trucking sector has worsened, with rising manufacturing activity and low inventories expanding regional tightness into a national capacity shortfall. Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

- Freight pricing continues to rise due to capacity constraints and the higher cost of operations due to the pandemic.

- The U.S. Coast Guard closed ports along the Louisiana coast, including the port of New Orleans.

- Railroad operations in the Gulf Coast and other portions of the rail network also are expected to be impacted by the tropical storms, which may extend transit times.

- Beyond the transportation challenges, our Gold Standard logistics partners continue to operate without interruption.

Markets

- COVID-19 statistics in the U.S. continued to trend downward, with 34,567 new cases and 449 deaths yesterday.

- The FDA issued an Emergency Use Authorization for using blood plasma from recovered patients as a treatment for COVID-19.

- Monoclonal antibodies, which mimic the body’s immune defenses and could arrest the advance of COVID-19 if administered in patients early, will soon go into human testing.

- “Long haulers,” younger patients with prolonged health effects from COVID-19, met with the World Health Organization on Friday to seek recognition for their conditions and plight.

- In another unexpected health consequence of COVID-19, many patients are experiencing “prolonged coma” after being taken off ventilators.

- The first confirmed reinfection was detected in Hong Kong in a man who tested positive after recovering from an initial bout of COVID-19 a few months ago.

- The U.S. Purchasing Managers’ Index rose to 54.7 in August from 50.3 in July, signaling the strongest economic activity since the pandemic struck.

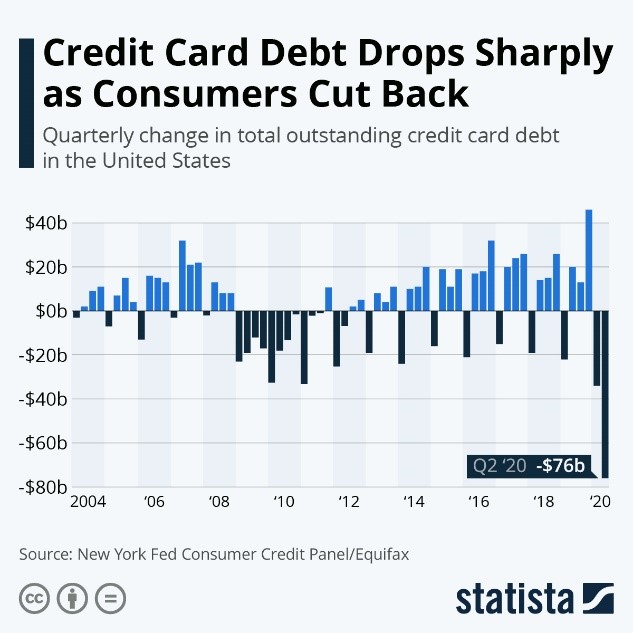

- Credit card debt plunged in the second quarter, the first decline since 2014, as consumers spent less and used stimulus money to pay down debt:

- About half of economists surveyed by the National Association for Business Economics don’t expect the economy to return to pre-pandemic health until 2022, and a majority believe there is at least a one-in-four chance the U.S. will experience a double dip recession.

- Existing home sales rose 8.7% in July compared with the prior-year period, and the medium price of a home exceeded $300,000 for the first time as the supply of available homes remained tight.

- Major movie theater chains reopened on Friday.

- Many major employers are delaying their return to the office as both the spread of the pandemic and the productivity of work-at-home employees exceed early expectations.

- Once a vaccine is discovered, people may be required to show proof of inoculation to enter offices, restaurants, sports venues, etc.

- College towns are facing the twin threats of rising infections and fiscal crisis as students return to restricted campus life.

- Stanford, joining a growing number of colleges to slash their athletic programs to address budget deficits, will eliminate 11 sports that have been feeders to U.S. Olympics teams.

- A recent German study suggests that airline ventilation systems are largely effective in mitigating the spread of COVID-19.

International

- COVID-19 infections are rising in Europe, sparking concerns about a second wave of the virus:

- Spain, with new COVID-19 cases averaging more than 5,000 a day, now accounts for about a third of new infections in Europe.

- France recorded nearly 5,000 new COVID-19 infections on Sunday, its highest since May.

- Italy suffered 1,071 new COVID-19 infections on Friday, its highest since lifting restrictions in mid-May, driven by travelers returning from vacations.

- Germany reported more than 2,000 COVID-19 cases on Saturday, its highest daily infection rate since April.

- Life in most of China has returned to near normal, with bars and restaurants open without social distancing mandates and the COVID-19 infection rate at near zero.

- South Korea, experiencing the highest daily infection rates since March, expanded social distancing restrictions and warned that it is “on the brink of a nationwide pandemic” as infections rose in all regions of the country.

- COVID-19 cases in India jumped from 2 million to over 3.1 million in just 17 days. The country ranks third behind the U.S. and Brazil in total infections.

- Total COVID-19 deaths in Mexico topped 60,000, the third highest globally behind the U.S. and Brazil.

- South Africa’s wine industry, ranked eighth largest globally, is reeling after 14 weeks of banned liquor sales in the country with many vintners not expected to survive.

Our Operations

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Lindy Holland.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.