COVID-19 Bulletin: August 18

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- After ending up yesterday, crude prices were down in early trading today, with the WTI at $42.35/bbl and Brent at $45.06/bbl.

- The White House plans to auction off drilling rights to the Arctic National Wildlife Refuge in Alaska.

- Foreign firms, stung by supply chain vulnerabilities during the pandemic, could incur over $1 trillion in costs to relocate their supply chains from China over the next five years, according to Bank of America.

- Chevron is in talks to explore for oil in a southern province of Iraq, OPEC’s second largest oil producer, while high-quality oil reserves are cheap during the pandemic and energy recession.

- We are seeing resin supplies tighten in commodity markets.

Supply Chain

- The White House pledged to provide tax incentives to companies that return jobs from China and to impose tariffs on companies that create jobs overseas, further straining U.S./China relations and portending disruption in global supply chains.

- China’s share of global exports has shrunk from 25% last year to 22% this year, and its share of consumer goods exports has fallen from 46% to 42 % as U.S./China geopolitical tensions mount.

- Amazon continues to expand its delivery capacity, handling 66% of its package shipments in July, up from 61% in the second quarter.

- Freight markets remain challenged. Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

- We’re seeing rising spot freight pricing due to capacity constraints in the industry.

- Beyond the transportation challenges, our Gold Standard logistics partners and U.S. ports continue to operate without interruption.

Markets

- The FDA gave emergency approval to SalivaDirect, a faster and cheaper COVID-19 test developed at Yale University that uses saliva as a test specimen and is expected to cost about $10 for lab analysis.

- Just-reopened schools across the country are spawning COVID-19 clusters that are infecting students and faculty alike, forcing thousands back into remote learning and quarantine.

- New Jersey’s COVID-19 infection transmission rate climbed above 1.0, a signal that the infection is spreading again.

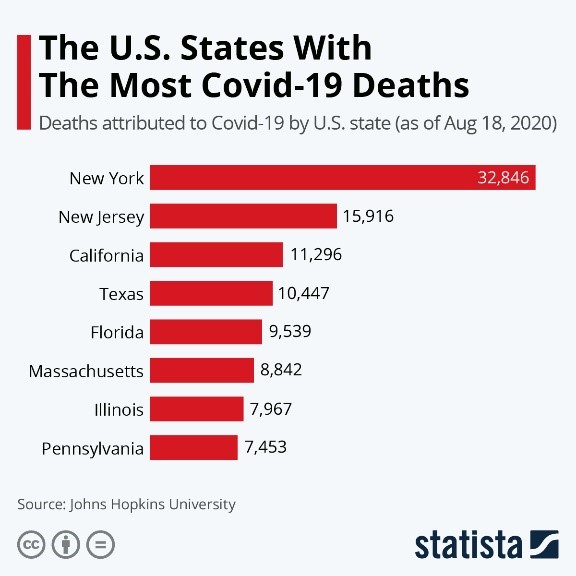

- New York has incurred the highest COVID-19 death rate by far:

- Walgreens is offering flu shots at all of its pharmacies as the CDC warns of the health risks of a “twindemic” as the COVID-19 pandemic collides with the normal influenza season.

- Mortgage delinquencies in the second quarter rose more than 8% year-over-year, a nine-year high, while FHA delinquencies among first-time buyers surged 16% to a record high.

- Optimism rose among home builders, marked by a rise in the National Association of Home Builders housing index from 74 in July to 78 in August, driven by historically low interest rates and a migration of some urban dwellers to suburbs.

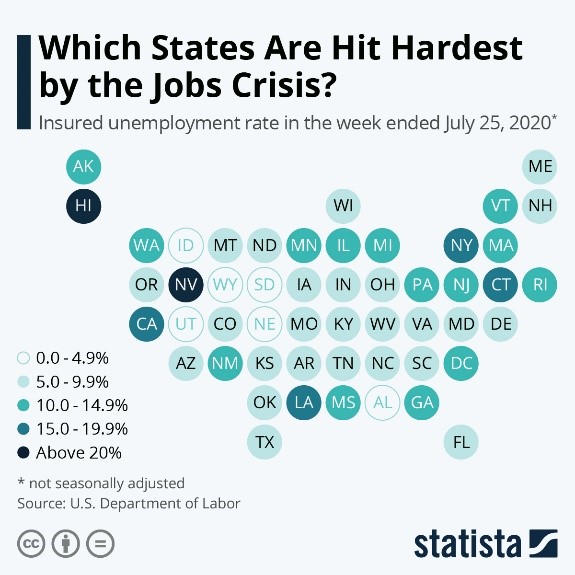

- Employment in Hawaii and Nevada, with their large tourism industries, has been hardest hit by the pandemic:

- Walmart reported stronger-than-expected second-quarter results fueled by a near doubling of online sales and strong performance by its industry-leading grocery business.

- Five automakers comprising 30% of U.S. automobile sales — Ford, Honda, BMW, Volkswagen and Volvo — signed an agreement with California to comply with the state’s tailpipe emission rules that require them to raise their average fleet efficiency from 37 miles per gallon today to 51 miles per gallon by 2026. The state regulations are stricter than recently scaled back federal rules.

- Uber and Lyft are considering franchise business models for California if a court backs a new state law declaring that the ride sharers’ drivers are employees and not contractors.

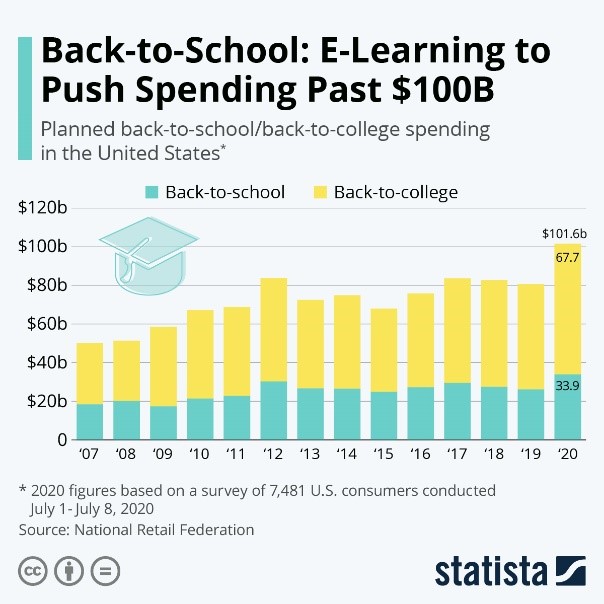

- Back-to-school spending, boosted by remote learning requirements, is expected to hit an all-time high this year:

- COVID-19 has infected mink at two mink farms in Utah, the country’s second largest mink producer, where farm workers also have been detected with the virus.

- Major retailers are trending to returnable reusable packaging as an alternative to recycling to drive sustainability.

- Global COVID-19 cases neared 22 million today.

International

- Add “wing-shaped” to “v-shaped” and “u-shaped” as descriptions of the economic rebound, as Europe’s recovery falters in the wake of rising COVID-19 infection rates and renewed social distancing restrictions, subpar trade and consumer concerns.

- Germany, Europe’s largest economy, experienced the highest number of new COVID-19 infections in four months yesterday, prompting concerns about Europe’s economic recovery.

- Officials in France are urging citizens to honor face mask and social distancing restrictions with recent infection rates in the country exceeding 3,000 a day, twice the rate at the beginning of the month, with 30% in the 17-44 age group.

- Israel’s economy shrank at an annualized rate of 28.7% in the second quarter, the steepest contraction since 1975.

- Global air travel remains down 85% from this same time last year, and the industry is expected to incur $84 billion in losses in 2020.

- South Korea is banning worship services and closing bars and restaurants in several cities to fight an alarming surge in COVID-19 infections.

- A man has been sentenced to five months in prison for violating quarantine and bringing a mutated form of COVID-19 to Malaysia from India. Scientists are unsure if the mutated strain of the virus, which pervades in the U.S. and Europe, is more contagious or transmissible than the initial strain.

- Thousands of U.S. nationals residing in China who left during the pandemic are now stranded by the country’s border restrictions, posing challenges for their employers and mitigating a buffer to U.S./China geopolitical tensions.

- Coca-Cola introduced its new CanCollar packaging solution in Europe, a recyclable paperboard collar for multipack cans.

- Scientists in Australia studying various types of seafood detected plastics in every sample tested.

- Italy experienced a 10% drop in garbage during its lockdown in March and April, despite a large rise in plastic waste from safety gear and single-use items.

Our Operations

- We announced on Friday that our Northbrook and Chicago, Illinois, offices will remain closed at least through the end of the year.

- We are moving and expanding our 3D Printing business unit to the mHUB manufacturing innovation complex in Chicago.

- We are proud that Crain’s Chicago Business has ranked M. Holland as one of its Top 100 Best Places to Work.

- Tomorrow: Join our Fireside Chat. Panelists from M. Holland and Plante Moran will discuss the new USMCA and how it will impact businesses, the economy and the plastics industry. Register here to gain insight from the following panelists:

- Alejandro Rodriguez, Principal and Country Manager, Mexico at Plante Moran

- Lou Longo, International Consulting Practice Leader at Plante Moran

- Dwight Morgan, Executive Vice President, Corporate Development at M. Holland

- Eugenio Calderón,Vice President, International at M. Holland

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.