COVID-19 Bulletin: August 12

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices approached a five-month high yesterday on a larger-than-expected drop in U.S. inventories.

- Crude prices were higher in early trading today, with the WTI at $42.23/bbl and Brent at $45.14/bbl.

- The former head of Pemex, Mexico’s state-owned oil company, accused the country’s former president of bribery.

- Occidental Petroleum will focus on debt reduction and pause increasing production after posting an $8.3 billion quarterly loss, weighed by its ill-timed acquisition of Anadarko Petroleum last year.

- Oil is no longer the primary focus or most profitable product of petrochemical companies, as they reposition themselves as energy companies in an environmentally conscious world.

Supply Chain

- A week after Tropical Storm Isaias churned through, some areas in the Northeast remain without power and internet.

- According to a recent McKinsey & Company study, artificial intelligence can improve supply chain efficiency and reduce costs by more than 50%.

- Freight markets remain challenged. Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

- We’re seeing rising spot freight pricing due to capacity constraints in the industry.

- Beyond the transportation challenges, our Gold Standard logistics partners and U.S. ports continue to operate without interruption.

Markets

- COVID-19 deaths topped 1,300 yesterday, with Florida and Georgia registering single-day highs.

- Negotiations remained stalled among leaders in Washington, D.C. regarding a fourth rescue package.

- Employers are wary of the White House’s deferred payroll order, which will create administrative challenges and could leave them on the hook for employee deferred income tax liabilities when they become due in 2021.

- The White House’s $300 supplemental unemployment program has only about six weeks of available funding if all states participate.

- State and local officials are hampered in their pandemic response by data delays and inaccuracies since the federal government ordered hospitals to bypass the CDC and send information directly to the Department of Health and Human Services.

- Bars and restaurants are emerging as breeding grounds for community outbreaks of COVID-19.

- The federal government entered a $1.5 billion contract with Moderna to provide 100 million doses of its vaccine under development as part of the government’s Warp Speed program.

- U.S. companies shed 134,000 IT jobs in July, the first drop in IT employment since the pandemic struck in March. Job postings in the sector also declined.

- With global Airbnb bookings returning to pre-pandemic levels, the home-sharing company is planning to go public.

- Tesla, now the world’s most valuable automotive company, plans a 5-for-1 stock split.

- Boeing delivered just four airliners in July and has canceled orders for 400 of its still-grounded 737 Max jets.

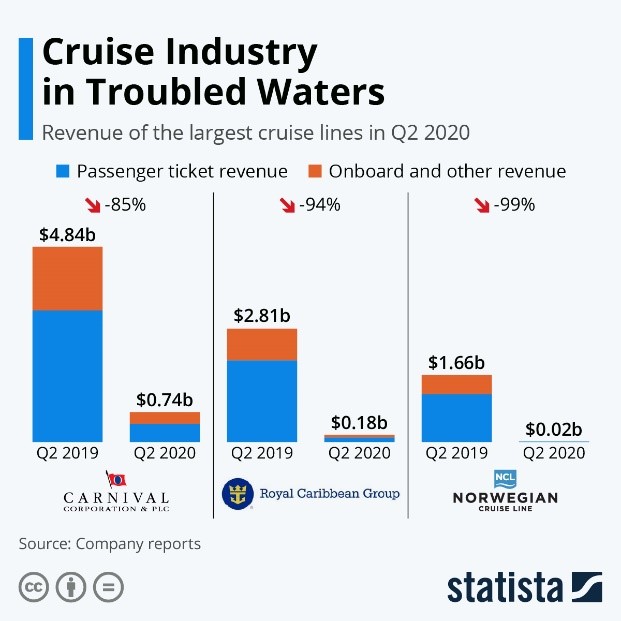

- Some 12,000 cruise workers remain stranded on ships after the industry extended its reopening for the third time until November 1.

- Few segments of the travel and leisure industry have been as hard hit as cruise lines, with ships considered incubators for COVID-19:

- After years of rapid expansion, coworking companies are closing unprofitable locations and shrinking their footprints.

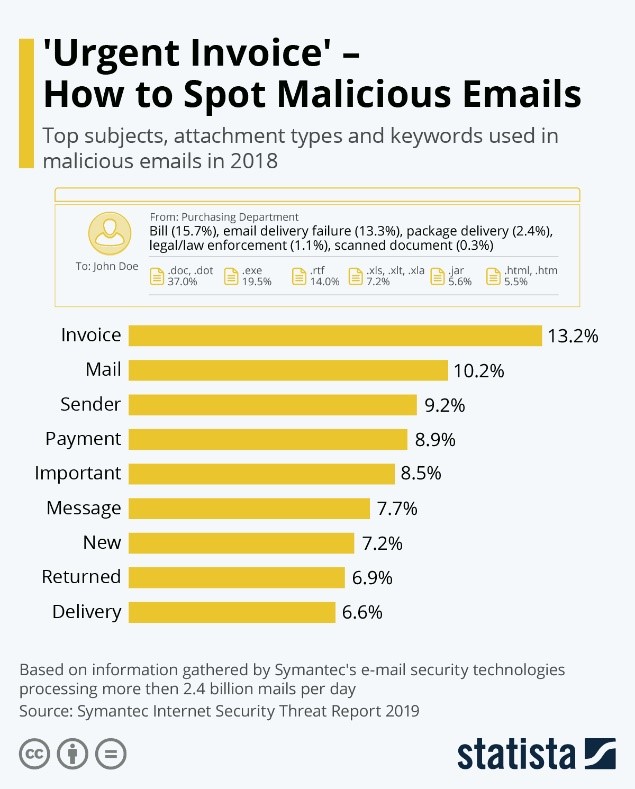

- With record numbers working from home, cybersecurity attacks are on the rise; global distributed denial of service (DDoS) attacks were up 217% in the second quarter.

- The NCAA’s Big Ten Conference will postpone its football season until spring rather than cancel it altogether, as earlier reported. The PAC-12 also is postponing its season.

- A return to athletic playing fields could be hampered by a heart condition found in some recovered COVID-19 patients that mimics the symptoms of a heart attack, including potential death.

- Global COVID-19 cases topped 20.4 million.

International

- The head of the U.S. National Economic Council expressed confidence that the Phase 1 trade deal with China remains intact, despite growing tensions between the two countries.

- The U.K. economy shrank over 20% from the first quarter to the second, a record drop and the biggest contraction among developed nations, returning to its size in 2003.

- New Zealand, which went 102 days without an incident of COVID-19 community spread, has restored lockdowns after experiencing an outbreak.

- Canada’s list of U.S. goods subject to 10% retaliatory tariffs includes a broad range of raw materials, intermediate goods and finished goods, including household appliances and sporting goods.

Our Operations

- We are proud that Crain’s Chicago Business has ranked M. Holland as one of its Top 100 Best Places to Work.

- Join us for our next Fireside Chat on August 19. Panelists from M. Holland and Plante Moran will discuss the new USMCA and how it will impact businesses, the economy and the plastics industry. For more information and to register, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.