COVID-19 Bulletin: August 4

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Crude prices were higher in mid-day trading today, with the WTI up 2.1% at $41.88/bbl and Brent up 1.1% at 44.64/bbl.

- BP said it will hasten its move to low-carbon energy investments as it recognized $9.2 billion in impairment charges, reported a $16.8 billion second-quarter loss and halved its dividend.

- Russia’s oil output was down 16% in July from the year-ago period. The Ministry of Finance in Russia has proposed raising taxes on the industry by $1.9 billion over the next two years to help with yawning budget deficits.

Supply Chain

- With online sales up 76% in June from the prior-year period and 60% of consumers planning to do more online shopping this holiday season, retailers are scrambling to lock up additional warehouse space.

- Isaias made landfall in North Carolina with high winds and heavy rain, leading states along its East Coast path to issue warnings.

- We’re seeing the truckload freight market continuing to tighten. Some LTL shippers are resorting to truckload quantities due to LTL delivery challenges caused by labor shortages and operational delays from COVID-19 protocols. Clients are advised to provide expanded lead times on orders to help assure delivery dates will be met.

- Beyond the transportation challenges, our Gold Standard logistics partners and U.S. ports continue to operate without interruption.

Markets

- Easing new COVID-19 case counts in epicenters California, Florida and Texas helped bring down new infections in the country to over 47,000 yesterday, the lowest daily rate in nearly a month.

- Facing a rising COVID-19 transmission rate, New Jersey tightened restrictions, including reducing limits for indoor crowds to 25 people and mandating face masks for returning students.

- Missouri, Montana and Oklahoma are among states experiencing the highest percentage increases in infections as concerns grow about outbreaks in the Central and Midwest regions of the country.

- The White House and Congress continue to struggle finding common ground for a fourth pandemic aid package, with big differences over enhanced unemployment benefits, eviction protections, and aid to state and local governments.

- Assuming the federal government passes another $1 trillion rescue package, the Treasury Department expects to borrow an additional $2 trillion in the second half of the fiscal year. That would raise borrowings for the full year to $4.5 trillion, dwarfing levels during the Great Recession.

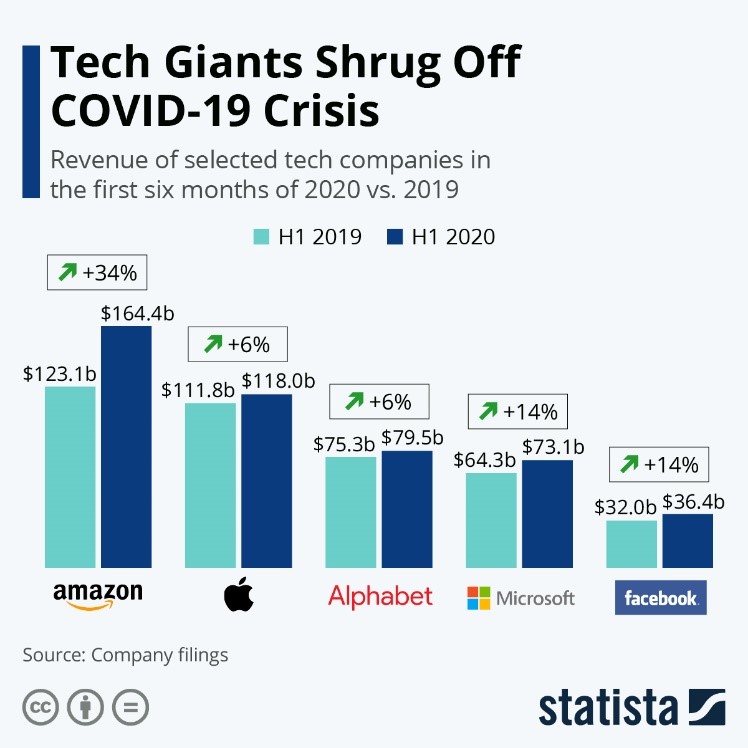

- The technology giants have been unscathed or boosted by the pandemic:

- Medical equipment maker Stryker reported that second-quarter sales fell 24% due to a drop in elective surgeries during the pandemic but was optimistic about the momentum of recovering demand.

- Long-term effects of COVID-19 will lead to billions of dollars in healthcare costs akin to the health damage of those affected by the HIV virus and the 9/11 attacks.

- Ford announced that CEO Jim Hackett will be retiring and replaced by COO Jim Farley.

- People are driving less and keeping their cars longer during the pandemic, causing a 22% drop in used car inventories at dealerships at the same time bargain-hungry shoppers are increasing used car demand.

- Hyundai and Mazda reported higher year-over-year sales in the U.S. in July, while Honda, Kia and Toyota saw smaller sales declines in a steadily recovering industry.

- Electric truck startup Lordstown Motors became the third electric vehicle company to recently announce it will go public.

- Diageo, the world’s largest spirits company, reported strong second-quarter sales in North America but, due to pandemic lockdowns, saw sales fall 17% in India, 15% in Latin America, 13% in Africa and 12% in Europe. Overall, organic sales fell a steeper-than-expected 8.4%.

- Researchers at the University of Massachusetts have developed a hybrid manufacturing process called Injection Printing that combines 3D printing with injection molding to create solid parts with greater speed and strength than 3D printing alone.

- California is trialing a new TechniSoil product for replacing hot-mix asphalt with recycled plastic for resurfacing roadways. The process consumes the equivalent of 150,000 plastic bottles per lane mile.

- The Harvard Global Health Institute launched a Pandemics Explained website with an interactive map assessing county-by-county risk in the United States.

- Global COVID-19 deaths are approaching 700,000.

International

- The man leading India’s government response to COVID-19 has been infected by the virus amid concerns that the country, which ranks third in infections globally, is understating fatalities.

- Vehicle sales in China rose nearly 15% in July compared with the prior-year period, the fourth month of increasing sales amid generous government and dealer incentives.

- The pandemic has changed coffee drinking habits and disrupted coffee prices. Arabica varieties, grown in Latin America and used mostly in coffee shops and restaurants, suffered a 9% price drop, while prices for Robusta varieties, grown in Asia and used in coffee pods and freeze-dried products, have slipped just 3%.

- The weak U.S. dollar may not provide a boon to emerging countries grappling with the health and economic implications of the pandemic.

Our Operations

- Join us for our next Fireside Chat on August 19. Panelists from M. Holland and Plante Moran will discuss the new USMCA and how it will impact businesses, the economy and the plastics industry. For more information and to register, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Lindy Holland.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.