COVID-19 Bulletin: July 17

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Crude prices were modestly lower in mid-day trading with the WTI price at $40.70/bbl and Brent at $43.20/bbl.

- In an interview, the CEO of Royal Dutch Shell painted a dour outlook for the energy industry, predicting that the economy will not experience a V-shaped recovery and that the pandemic will impact consumption for many years to come.

Supply Chain

- Transportation bellwether J.B. Hunt reported better-than-expected second-quarter results, but its intermodal, brokerage and final-mile businesses struggled. The company is cautious about the outlook for the remainder of the year due to rising COVID-19 infections.

- Our Gold Standard logistics partners and U.S. ports continue to return to normal operations.

Markets

- COVID-19 cases topped 77,000 yesterday, exceeding the prior single-day record of 69,070 set last Friday.

- Yesterday, Florida recorded more than 14,000 new cases and set records for fatalities (156) and total hospitalizations (19,825). The state was forced to close its pandemic response center when 13 staffers tested positive for the virus.

- Arkansas and Colorado joined a growing list of states mandating the use of face masks in indoor public places, while Georgia and Atlanta went to court over the state’s prohibition of face mask mandates by local governments.

- With 45% of counties in the U.S. experiencing an “epic trend” of COVID-19 spread, the national fatality rate could hit 220,000 by November, according to global mapping company Esri.

- The jobs recovery appears to be waning with job openings in July down in all 50 states and across market sectors.

- Concerns are growing about the pending expiration of several pandemic aid programs, including the eviction moratorium for federally insured multifamily homes on July 24, unemployment subsidies at the end of the month, the Paycheck Protection Program in early August, and the payroll support program for airlines at the end of September.

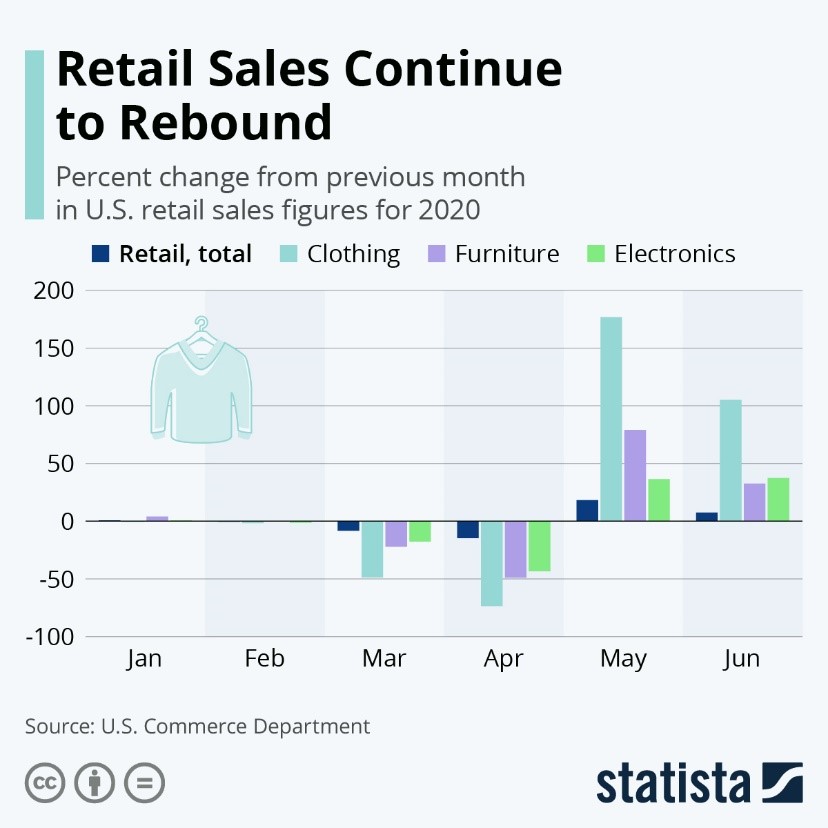

- Retail sales, fueled by stimulus programs that are expiring soon, rose a higher-than-expected 7.5% in June, with big gains in restaurant spending and sales of big-ticket items offsetting small declines in the online and building materials sectors.

- Some segments most impacted early in the pandemic continue to rebound:

- Investment advisor UBS projects 25,000 bricks-and-mortar retail stores will be permanently shuttered this year, dwarfing the record 9,800 stores that closed in 2019.

- Mortgage rates set a record low for the seventh time this year with the 30-year fixed rate falling below 3% for the first time.

- Home construction starts jumped 17% in June, the biggest increase since 2016, but housing starts remained 4% below June 2019.

- The pandemic has prompted British Airways to permanently retire its entire fleet of 37 Boeing 747 jets, the largest 747 fleet in the world.

- Lyft is providing its most active drivers with plastic partitions to protect them from infection.

- New York state will spend more than $700 million to build infrastructure to support electric vehicles in pursuit of its goal of reducing carbon emissions by 80% by 2050.

- Porsche is achieving weight reduction and design innovation using 3D printing to produce pistons, resulting in higher car performance and efficiency.

- Healthcare will be among the biggest beneficiaries of 5G wireless technology, enabling speedier and more convenient medical care for patients and saving the industry up to $94 billion annually as telemedicine takes hold.

- The CDC extended its ban on cruises from July 24 to September 30. The industry had previously announced it would voluntarily suspend cruises until September 15.

- School systems across the country are struggling with whether and how to reopen for the fall session, creating uncertainty and conflict for teachers and parents, especially working parents.

- Global infections are poised to break 14 million this weekend.

International

- A surge in COVID-19 cases in India drove total infections past 1 million today, propelling the country past Russia into third place for total infections behind the U.S. and Brazil. India re-imposed lockdown restrictions after easing them in recent weeks.

- Infections in Brazil passed 2 million.

- China said it remains committed to the Phase 1 trade deal with the U.S. despite rising tensions between the world’s two largest economic powers.

- The European Central Bank’s quarterly survey of economic forecasters reaffirmed the outlook for a deep contraction for the European Union economy this year followed by a sharp rebound next. The bank, citing continuing downside risks, committed to exercise the “entire envelope” of its stimulus efforts.

- Puerto Rico, home to M. Holland Export Services, is re-imposing closures of bars, theaters and casinos and extending curfews as infections there rise.

- The Group of 20 industrial nations will meet virtually on Saturday to consider extending ways to help developing nations, including a possible extension of debt relief put in place three months ago.

- Spanish authorities ordered the closure of a mink farm and the culling of nearly 100,000 animals after many were detected with COVID-19. The detection follows the slaughter of nearly 1 million mink in the Netherlands in May when it was determined the animals can spread the virus asymptomatically amid suspicions of animal-to-human transmission.

- Electrical and electronics production in Brazil was down 34% in May.

Our Operations

- For clients seeking the convenience of accessing order status, order history, invoices, bills of lading and other information online, contact Tara Cutaia, Director of Client Experience, to sign up for our proprietary MHX app.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Lindy Holland.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.