COVID-19 Bulletin: July 1

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices were modestly higher in mid-day trading today with the WTI crude price at $39.70/bbl and Brent at $41.97/bbl.

- The Energy Information Administration reported that U.S. oil inventories fell 7.2 million barrels last week, more than expected.

Supply Chain

- A surge in residential deliveries and trans-Pacific and charter flights more than offset a drop in commercial business for FedEx, which reported better-than-expected results for the second quarter.

- Shipping companies are slashing investments in “clean ship” initiatives due to the pandemic, threatening the industry’s goal of cutting carbon emissions by 50% by 2050.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

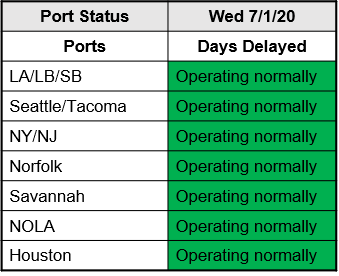

- Ports are operating normally:

Markets

- The U.S. suffered more than 47,000 COVID-19 infections yesterday, a new high, making the past six days the highest during the pandemic.

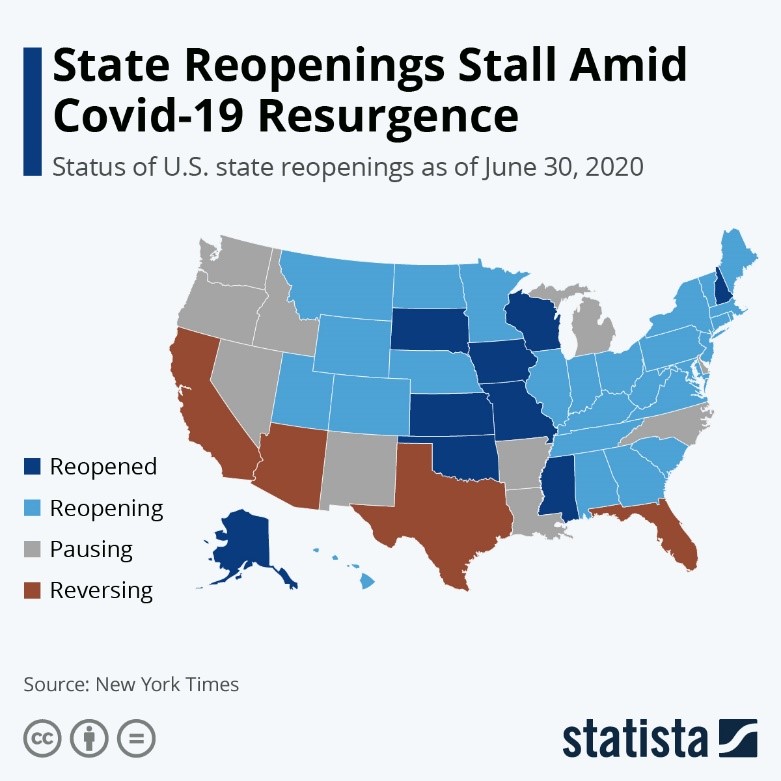

- A growing number of states have slowed or reversed reopening plans.

- The head of the National Institutes of Health warned Congress that daily infections in the U.S. could reach 100,000 without stronger mitigation efforts.

- Speaking before Congress, the head of the Federal Reserve acknowledged the economy’s rebound but warned that a lasting recovery requires taming the virus; the Treasury Secretary indicated that the White House wants to pass another round of federal stimulus by the end of July.

- The Senate passed a last-minute measure to extend the Paycheck Protection Program until August 8 just hours before the program was set to expire. The bill now goes to the House of Representatives.

- The Institute for Supply Management’s manufacturing index climbed to 52.6 in June. A reading above 50 signals expanding growth.

- Despite the pandemic, the S&P ended June with its highest quarterly percentage gain since 1998.

- ADP said U.S. companies added 2.4 million jobs in June, fewer than expected.

- More than 4 million workers have suffered income cuts during the pandemic due to salary reductions and reduced hours, raising concerns about the economic recovery.

- More than 200 jobless people waiting to file for unemployment formed an overnight camp in Oklahoma City when officials were unable to accommodate the long lines on Monday.

- The local union has asked GM to temporarily close its Arlington, Texas, plant due to high infection rates in the state.

- A U.S. Customs official said the agency will adopt an “informed compliance period” through mid-2021 for enforcement of the new USMCA treaty, allowing auto manufacturers to avoid compliance penalties for up to a year.

- Year-over-year home prices rose 4.7% in April, but existing home sales fell to their lowest level in a decade. Demand has rebounded in May, but supply remains constrained.

- Construction spending fell 2.1% in May.

- Insurance companies are resisting a cavalcade of claims for business interruption insurance due to the pandemic, prompting a rash of lawsuits. The industry could face $25 billion in liabilities.

- Microsoft will offer free digital tools training to an estimated 25 million people globally to help prepare them for occupations in an increasingly digital economy fostered by the pandemic.

International

- The Purchasing Managers Index in China rose to 51.2 in June, the best reading since December. A score above 50 indicates an expanding factory sector. Overseas demand remained weak.

- Canada’s GDP contracted 11.6% in April and should show 3% growth in May. The nation’s economy never contracted more than 1.5% in a single month in the past 60 years.

- Aeroméxico, became the third major Latin American airline to file for bankruptcy. Delta, which owns 49% of Aeromexico and 20% of Chile’s bankrupt LATAM Airlines, could face impairment charges.

- Airbus faces challenges from European governments after announcing it will cut 15,000 jobs in its commercial aircraft division.

- One of Ecuador’s largest cities, once among the hardest hit by COVID-19, has tamed the virus using data and by sending medical personnel into hard-hit neighborhoods, creating a model for other poor cities.

Our Operations

- For clients seeking the convenience of accessing order status, order history, invoices, bills of lading and other information online, contact Tara Cutaia, Director of Client Experience, to sign up for our proprietary MHX app.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.