COVID-19 Bulletin: June 26

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices were modestly lower in mid-day trading with the WTI crude price at $38.17/bbl and Brent at $40.77/bbl.

- S&P Global Platts and Argus Media are initiating a new pricing benchmark for Gulf Coast crude delivered to international markets as an alternative to the WTI, which is based on domestic delivery.

- COVID-19 infections in Houston could triple or quadruple in coming weeks, warned a leading health expert, swamping the area’s already stretched healthcare system. The governor of Texas paused reopening measures and suspended elective surgeries.

- Major oil companies are stepping up investments in hydrogen as a green energy source but face many obstacles to wide-scale adoption, including cost.

- The cost of solar installations is falling faster than earlier anticipated due to a decrease in demand related to COVID-19, with residential-system costs expected to fall by 17% over the next five years and commercial-system costs falling 16%.

Supply Chain

- U.S. rail volume inched 2% higher last week compared with the prior week but remained 12.9% below the prior-year period.

- A surge in package deliveries has provided the U.S. Postal Service with a lifeline against its financial struggles.

- After decreasing in 2019, supply chain investments will increase in the wake of the pandemic as companies invest in technology and more warehouse space to create greater resilience in their supply chains.

- With COVID-19 creating consumer concern about the sourcing and handling of food, the Norwegian salmon industry and IBM have teamed up to use blockchain to trace salmon from inception to the dinner table.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

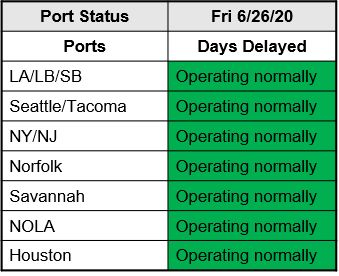

- Ports are operating normally:

Markets

- U.S. COVID-19 daily infections exceeded 40,000 yesterday, the second consecutive day of record new cases.

- The Commerce Department reported that U.S. consumer spending jumped 8.2% in May, but personal income fell 4.2%, signaling the spending acceleration may be muted going forward.

- The U.S. trade deficit for goods widened unexpectedly in May due in part to a decline in oil exports.

- Higher-than-expected jobless claims and rising infection rates are dimming hopes for a V-shaped economic recovery.

- The Federal Reserve determined that major U.S. banks have enough capital to weather the COVID-19 storm, which could cause $700 billion in loan losses, and ordered banks to freeze dividends and suspend stock buybacks.

- With 25% of small businesses facing the potential of permanent closure, many are wondering what happens to their loans under the Paycheck Protection Program. Since loans below $25,000 required no collateral or personal guarantees, many will be off the hook for repayment.

- The Treasury Department sent checks to 1.1 million deceased people in its rush to implement the stimulus program.

- The pandemic has prompted a 20% increase in online banking in Europe, accelerating the industry’s evolution toward an Amazon-like model for banking services.

- The COVID-19 crisis is challenging the highly fragmented construction industry, with well-healed players investing in virtual technology to connect with clients and tracing tools to protect employees, while thousands of smaller players are left vulnerable to health and economic uncertainty.

- The U.S.’s fractured response to COVID-19 is souring Europeans on American brands.

- Apple idled stores in Florida and has reclosed 10% of its stores nationwide in response to rising infection rates.

- Personal care company L’Oréal will source 100% of its plastics packaging from recycled or sustainable sources by 2030.

- Doctors are recognizing new health complications from the virus, including strokes and altered mental states among acute patients. The CDC added pregnancy to the list of high-risk conditions that can lead to severe complications from the virus with pregnant women five times more likely to be hospitalized.

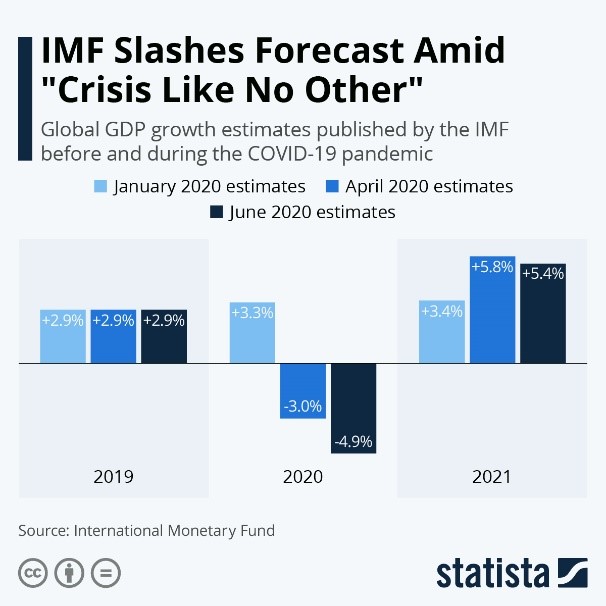

- The IMF lowered its economic outlook in light of the accelerating spread of the virus:

- Global COVID-19 infections approached 9.5 million today.

International

- New Delhi could experience an eight-fold increase in infections by the end of July as the city struggles with healthcare resources, and India, the world’s second most populated country, struggles with rising infections rates.

- Germany, which appeared to have tamed a recent spike in new COVID-19 cases, has locked down two counties in the face of new flareups.

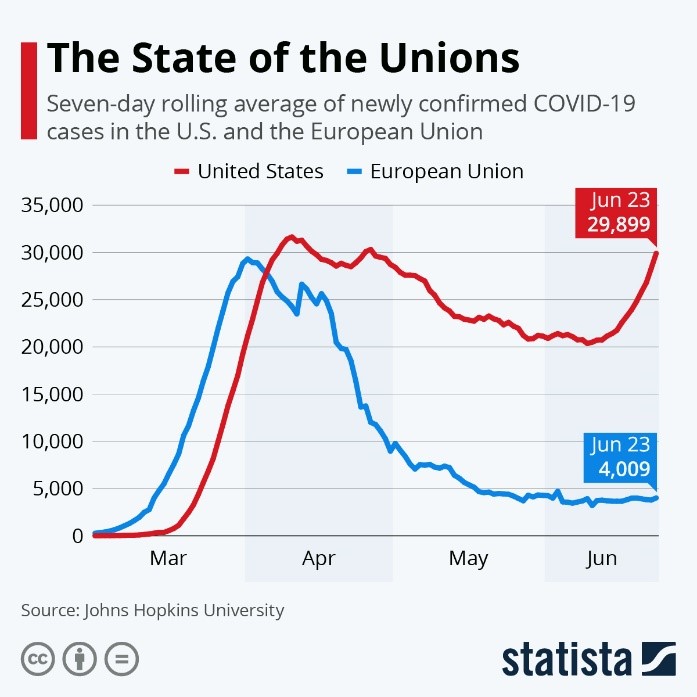

- Europe has successfully kept COVID-19 in check:

- Brazil’s president, who has resisted social distancing and other safety measures in favor of leaving the economy open, now says he may have had COVID-19 as early as March. Brazil ranks second behind the U.S. in deaths from the virus and recorded nearly 40,000 new cases yesterday.

- The World Health Organization added Sweden to its list of countries with the most acute health crises, prompting backlash from the epidemiologist responsible for the country’s lax response early in the pandemic. Sweden has the world’s third-highest death rate per capita with rising infections.

Our Operations

- For clients seeking the convenience of accessing order status, order history, invoices, bills of lading and other information online, contact Tara Cutaia, Director of Client Experience, to sign up for our proprietary MHX app.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.