COVID-19 Bulletin: June 18

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices were steady in early trading today, with the WTI at $37.9/bbl and Brent at $40.76/bbl.

- Saudi Arabia’s Aramco is suspending work on two offshore oil platforms and delaying an $18 billion natural gas project.

Supply Chain

- In a recent survey, 64% of manufacturers surveyed plan to reshore some production as the COVID-19 crisis has exposed their vulnerability to global supply chains and the JIT inventory model.

- A weekly pandemic index of industrial distributors showed an 8.5% revenue decline the week of June 12, breaking an improving trend.

- CVS is adding DoorDash to its stable of same-day delivery partners and now offers on-demand delivery of more than 3,000 non-prescription items.

- With historical data of little use in projecting supply chain demands amidst the disruption of the pandemic, companies are looking to digital technology such as artificial intelligence, the Internet of Things, blockchain and advanced analytics for real-time demand sensors.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

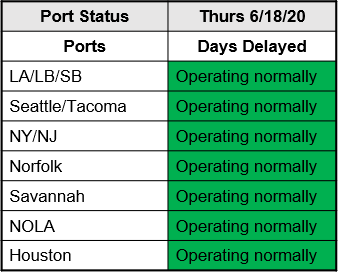

- Ports are operating normally:

Markets

- A higher-than-expected 1.5 million people filed for unemployment last week, the 13th straight week of a million-plus claims during which more than 45 million have filed. Those receiving benefits edged down slightly to 20.5 million people.

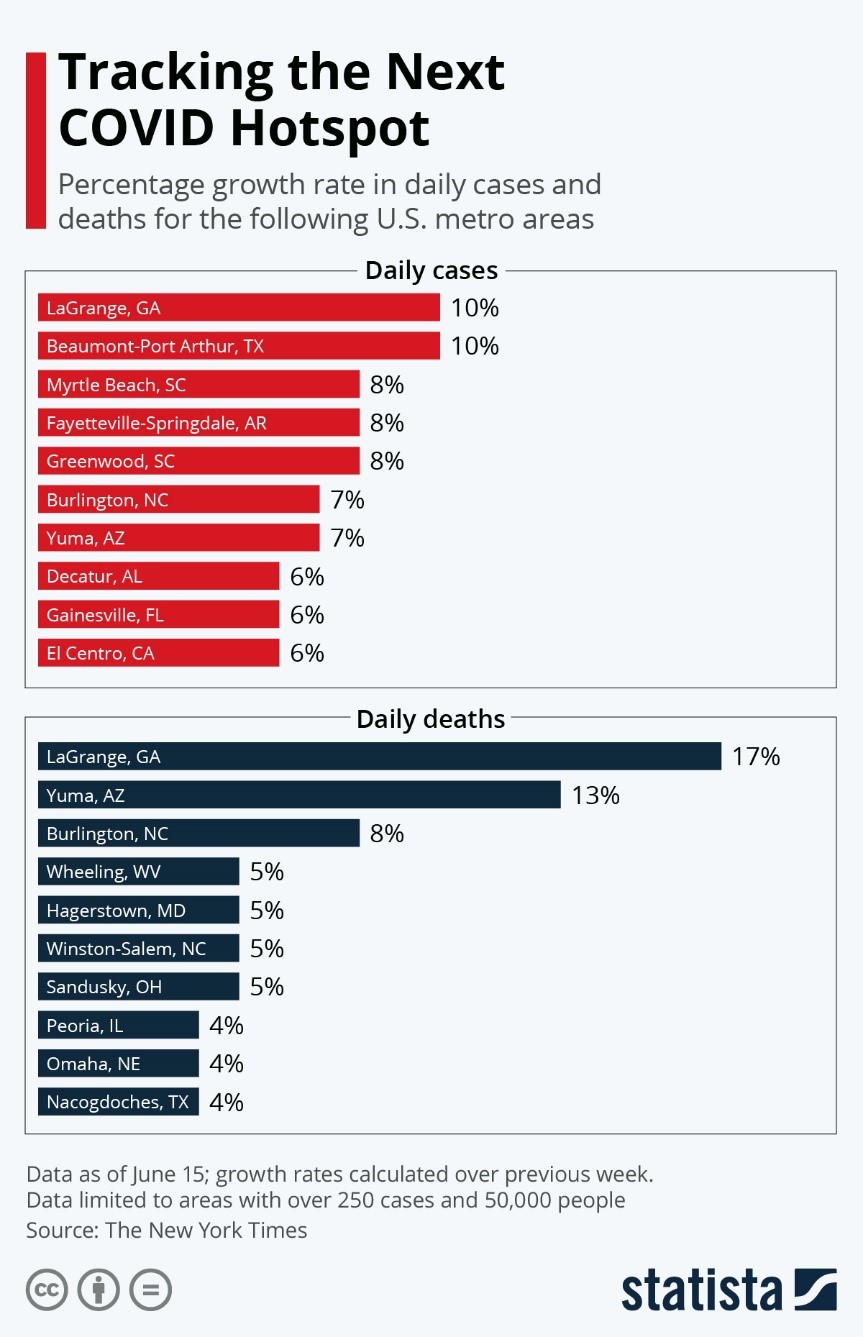

- Removing New York from the calculations, the U.S. five-day average infection rate per 100,000 people has risen from 6.2 to 7.5.

- More than 100 million consumer loans of various types were in forbearance at the end of May.

- The Secretary of Commerce said that talks among over 100 countries to agree on international tax rules for corporations are at an impasse, raising prospects for tax and trade disputes in the wake of the pandemic.

- The COVID-19 crisis will have worse economic impacts than the Great Recession and could wipe out $16 trillion in global wealth, impair growth prospects for half a decade, and widen the gap between haves and have-nots, according to Boston Consulting Group.

- Unlike other recessions, which tend to dampen migration, COVID-19 is prompting many to relocate from U.S. cities and big job markets for more favored locations where they can work remotely.

- Employee testing is a financial and emotional burden for many small businesses that lack the financial horsepower of larger companies.

- U.S. automakers have experienced no significant COVID-19 outbreaks since they reopened, providing encouragement that their safety protocols are working.

- Fiat Chrysler is canceling summer shutdowns at several North American plants due to unexpectedly strong demand.

- An expected 14% decline in demand for lithium batteries for e-vehicles this year will not slow their development, with growth of nine-fold expected by the end of the decade. Battery prices have fallen 87% in the past 10 years, bringing electric vehicle prices close to parity with traditional vehicles.

- With no national standards for safety protocols on flights, airlines are taking different approaches, creating concerns for passengers.

- Airlines are banning booze on flights to minimize contact between attendants and passengers.

- Pop-up theaters are emerging in cities across the country as cities and restaurants open parking lots as drive-in theaters and performance stages.

- Total confirmed cases exceeded 8.4 million globally with more than 450,000 fatalities.

International

- China said it has contained the latest outbreak in Beijing, where 158 have been infected after two months with no new cases in the nation’s capital and second largest city.

- Germany, facing sporadic COVID-19 outbreaks, extended social-distancing rules and a ban on large gatherings until October.

- The European Union plans to block foreign firms that receive state support and subsidies from acquiring EU firms, a move largely aimed at China.

- COVID-19 has prompted big changes in major cities, disparately impacting wealthy and poor neighborhoods, hammering public transit, reducing driving and ridesharing, shifting traffic patterns, and increasing bicycling and bike-sharing.

- Families of infected in Peru are resorting to the black market to buy life-saving oxygen at astronomical prices.

- The U.S. Department of State issued a level 2 travel advisory for Mexico, warning of the spread of COVID-19 and crime risk in some areas.

Our Operations

- Our 3D Printing team has designed innovative tools to assist us in eventually reopening our offices, including a hands-free dispenser for hand sanitizer, a low-contact thermometer, and a multi-purpose tool for opening doors and completing other tasks.

- Our white paper on materials selection for medical devices, referenced during last week’s webinar, is available here.

- For clients seeking the convenience of accessing order status, order history, invoices, bills of lading and other information online, contact Tara Cutaia, Director of Client Experience, to sign up for our proprietary MHX app.

- Our Color & Compounding team has introduced an expanded linecard of pulverized products for compounders.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.