COVID-19 Bulletin: June 11

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices sank in early trading today, with the WTI down 7.5% to $36.65/bbl and Brent down 6.6% to $38.97/bbl.

- Drilling activity in Venezuela is down 96% from January levels with just one active oil rig, one active gas rig and a third of its oil fields not producing.

- Pemex has begun suspending oil field contracts, effectively eliminating thousands of jobs in Mexico’s oil industry.

Supply Chain

- COVID-19 disruption is impacting all aspects of the home construction market, including hindered supply chains, longer lead times for permitting and inspections, new protocols at construction sites, and financing delays.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

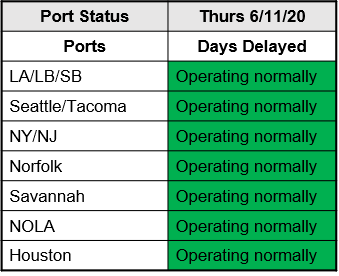

- Ports are operating normally:

Markets

- More than 1.5 million people filed unemployment claims last week, bringing the three-month total to more than 44 million. It was the tenth consecutive week of declining claims.

- The unemployment rate should decline to 9.3% by the end of 2020 and to 6.5% in 2021, according to the Central Bank, which predicts an economic recovery will begin in the second half of this year.

- Consumer prices fell 0.1% in May, the third consecutive monthly decline, despite increases in food prices. Core inflation, which omits food and energy prices, fell 0.4%.

- The federal government will fund phase 3 testing of three potential COVID-19 vaccines this summer.

- Just weeks after alternative-fuel truck developer Nikola went public, Tesla announced in an internal memo yesterday that it will commercialize its Tesla Semi electric truck, sending the company’s stock to over $1,000 a share and making it the second most valuable company in the world behind Toyota.

- Retailing continued its rapid transformation in the COVID-19 era:

- Starbucks will close some 400 traditional stores and focus on “convenience led” options such as drive-thru, pick-up and mobile-only locations.

- Signet, parent to Kay, Zales and Jared jewelers, will permanently shutter 380 stores after reporting that its same-store sales fell nearly 40% last quarter while online sales increased 6.7%.

- Leading fashion retailer Inditex, owner of Zara, Massimo Dutti and other top brands, will close up to 2,000 stores and invest $1.7 billion to better connect remaining stores with its online platform.

- Cosmetics chain Ulta Beauty is taking a clean-sheet review of all its more than 1,200 stores, assessing whether they should be closed, moved or remodeled.

- Returning workers will encounter a new office environment, which might include one-way aisles and hallways, workstations by app reservation, fewer meeting areas, standing safe zones while waiting at the printer and coffee machine, and signage everywhere.

- Incineration companies are seeing growth in new projects as nations turn to incineration to address a surge in global waste.

- Nearly 80% of Americans in a recent survey say they are more conscious of supporting green and sustainability responsible companies, with respondents saying they would pay an average of 26% more for fully sustainable products.

- Twenty-one states are experiencing rising COVID-19 infections.

- U.S. COVID-19 cases surpassed 2 million, more than twice the combined total of Brazil, Russia, U.K. and India, which round out the top five infected nations.

International

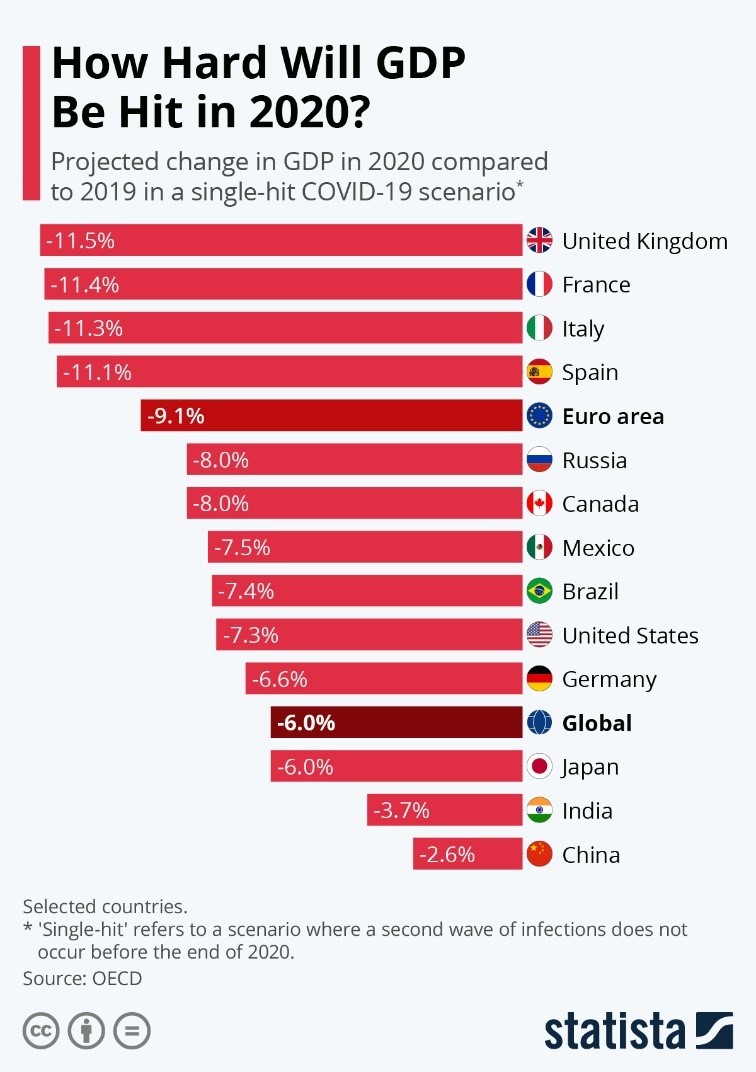

- Europe faces some of the harshest economic impacts of COVID-19 in 2020:

- Venezuela is on the brink of famine, as the oil-rich nation faces food shortages because it lacks enough fuel to plant fields.

- Canada’s economic recovery is trailing the recovery in the U.S. by several months.

- Producer prices in China fell 3.7% in May from the prior-year period.

- Vehicle sales in China rose 15% in May as the automotive industry recovery accelerates.

- Workers and health officials are concerned about infection and death rates in Mexico’s Maquiladora region, where factories have been pressed to reopen to support U.S. supply chains.

Our Operations

- Our Global Healthcare Manager Josh Blackmore was featured in an article in Medical Plastics News.

- Our Color & Compounding team has introduced an expanded linecard of pulverized products for compounders.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- For clients seeking the convenience of accessing order status, order history, invoices, bills of lading and other information online, contact Tara Cutaia, Director of Client Experience, to sign up for our proprietary MHX app.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.