COVID-19 Bulletin: May 27

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices slipped in early trading today, with the WTI down 2.2% to $33.59/bbl and Brent down 2.4% to $35.30/bbl.

- The oil price contango, which occurs when current prices fall below futures prices, has shrunk from nearly $13 in March to just $3.10 this morning as Asian economies improve and buyers snap up distressed surplus inventories.

- An unexpected impact from lower fuel demand: a shortage of carbon dioxide, a derivative of ethanol production, is raising costs and prices for carbonated beverages such as beer and soda.

Supply Chain

- Companies employing state-of-the-art logistics software have adapted quickly to COVID-19 supply chain disruptions, boosting demand for logistics software such as “visibility technology.”

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

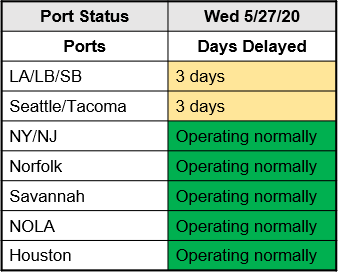

- On Tuesday, we saw delays at ports in California and Washington extend from two days to three days:

Markets

- The Conference Board’s Consumer Confidence Index (CCI) for the U.S. improved slightly in May to 86.6 from 85.7 in April. It stood at 134.1 in May 2019.

- Lumber futures prices have climbed 45% since the beginning of April due to mill cutbacks, rising home improvement sales and hopes for a quick rebound of home construction. Prices are up 8.9% from the prior-year level.

- Despite an 8.5% drop in home sales in March, home prices rose 4.4% on an annualized basis as fewer homeowners put their homes on the market and stimulus legislation allowed some to skip mortgage payments.

- COVID-19 cases are rising in 18 states, including many that were the earliest to reopen. The new case count is declining in only 10 states.

- The CDC warned that antibody testing can produce false readings up to half of the time.

- Amtrak projects that ridership will rise to only half of its pre-COVID-19 level in 2021. The financially strapped rail service will slash employment by 20%.

- With many production employees reluctant to return to factories and COVID-19 infection in humans among the greatest risks of business interruption, factory automation looks to accelerate.

- Prevalent wage and salary cuts have challenged the economic concept of “sticky wages” and could prolong the COVID-19 recession.

- Plastics are playing a vital role in fighting COVID-19 and will help fuel the economic transformation and recovery that follows.

- CEOs, grappling with the unprecedented pressures of dealing with the COVID-19 crisis, are leaning on their executive coaches more than ever.

- U.S. fatalities will surpass 100,000 today, just three months since the pandemic arrived, making COVID-19 the fastest killer in the country’s history.

- CDC guidelines recommend disposable utensils instead of reusable silverware for reopening restaurants.

- The U.K. has proposed a one-year delay for the U.N.’s annual conference on climate change, currently scheduled to take place in Glasgow in November after already being delayed from April.

International

- The combined GDP of the 37 members of the Organization for Economic Cooperation and Development (OECD) fell by 1.8% in the first quarter, the biggest quarterly drop since the Great Recession. OECD economies are expected to contract further in the second quarter and begin a rebound in the third.

- The head of the European Central Bank said the economic fallout from COVID-19 will be closer to the bank’s worst-case projections of an 8% to 12% decline in European output in 2020.

- The EU will consider a €750 billion ($826 billion) rescue plan for Europe, and Japan approved a 117 trillion yen ($1.1 trillion) stimulus plan.

- Electric vehicle sales will fall by more than 900,000 this year in China, the world’s largest e-vehicle market; financially stressed consumers and low gas prices are frustrating automakers who have invested heavily in the high-cost vehicles.

- Brazil’s daily fatality rate surpassed that of the U.S.

- South Korea experienced its second spike in a month and the largest daily infection rate in seven weeks due to a cluster traced to a logistics center.

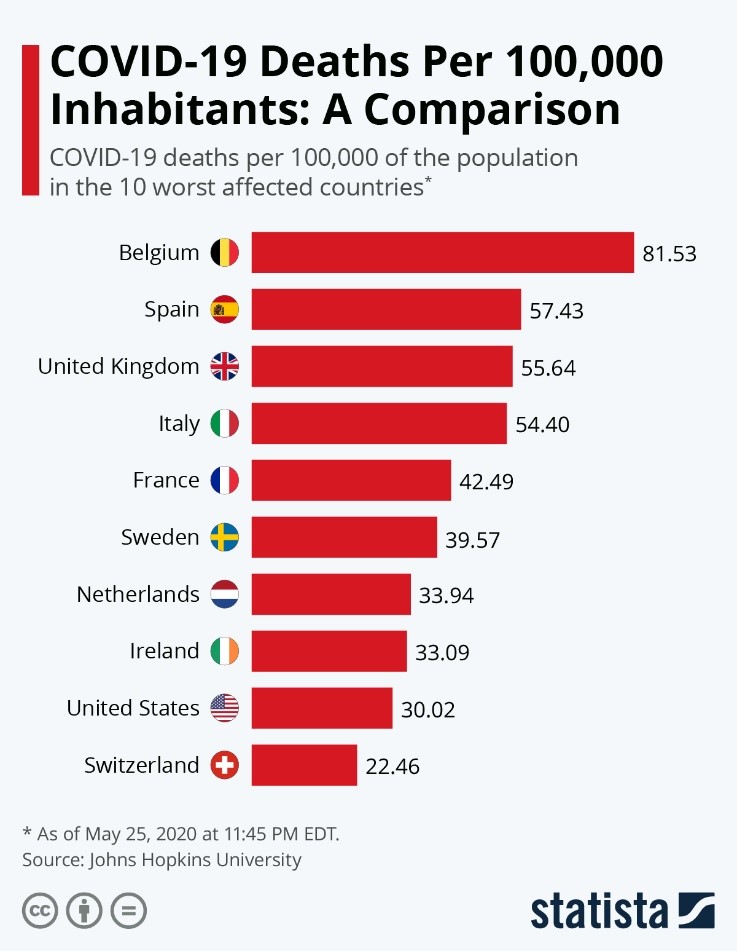

- European countries have the highest COVID-19 death rates per capita:

- Emerging nations face a historic debt crisis, with foreign currency debts of $8.4 trillion or 30% of their GDP, as they confront slowing growth, weak currencies and dwindling reserves.

- Retail sales in Russia fell 23% in April compared with the year-ago period, a far steeper drop than expected. The government, strapped from low prices for oil, its largest export, has avoided meaningful economic stimuli.

Our Operations

- M. Holland’s collaboration with Ford in the manufacture of medical safety equipment is featured in this just-published blog.

- Out of an abundance of caution for the safety of our people, we will leave offices closed and maintain remote work arrangements at least through July.

- M. Holland Company has entered a distribution partnership with leading polyolefin producer Braskem to distribute a new line of innovative polypropylene filaments, powder and pellets for 3D printing.

- Our Color & Compounding team has introduced an expanded linecard of pulverized products for compounders.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- M. Holland is fully operational and prepared to meet client needs for materials, material selection, logistics services and technical support.

- We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.