COVID-19 Bulletin: May 18

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices jumped in early trading, with the WTI up more than 10% to $32.53/bbl and Brent up nearly 7% to $34.76/bbl.

- Some beleaguered airlines are facing big write-offs on fuel hedges after oil prices collapsed to unexpected lows. Others de-emphasized hedging in favor of fuel surcharges after getting caught over-hedged in the oil and gas downturn five years ago.

- With demand down, utilities are cutting back on more expensive coal-fired generation in favor of natural gas and alternative energy, which could result in renewable sources overtaking coal for electricity production.

Supply Chain

- The government is considering tax breaks and a reshoring fund to incentivize companies to pull supply chains from China.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

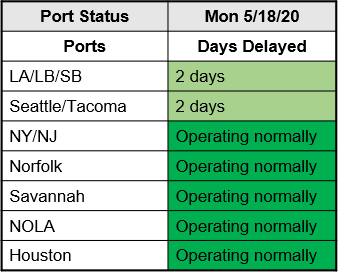

- U.S. ports continue to operate smoothly:

Markets

- Industrial production fell 11.2% in April from the prior month, with manufacturing down 13.7%, the largest monthly decline in more than a century of recordkeeping.

- Anecdotal evidence, such as increases in digital map usage, rising fast-food sales and increased Uber orders, suggest that the economy may have hit bottom.

- Job losses are impacting women more than men because of their heavier participation in segments of the service sector, a departure from past recessions. The unemployment rate for women in April was 16.2% versus 13.5% for men.

- The TSA will begin conducting temperature checks at a dozen airports.

- U.S. automobile makers began the process of reopening 51 plants today:

- The industry faces a backdrop of weak sales, higher costs, wary workers and financially strapped suppliers.

- Confusion emerged about the restart of Mexico’s automotive industry when the health minister said plants could resume full production on June 1, just hours after the economic minister announced they could reopen today. The government finally clarified that plants could reopen this week if proper safety measures are in place.

- A trade group leader estimates that 20% of automotive suppliers have less than eight weeks of liquidity left after the long shutdown.

- COVID-19 is reviving interest in car ownership among people who preferred ride sharing and public transportation, a rare bright spot for automobile sales.

- COVID-19 claimed its largest retailer yet last week, tipping 118-year-old J.C. Penney into bankruptcy following five years of declining sales and a decade without reporting a profit.

- Boat sales appear to be spiking, with buyers taking advantage of low interest rates in pursuit of recreation that assures social distancing.

- Housebound consumers are reviving sales of cow’s milk, a cheaper alternative to popular alternatives that have penetrated the market, and even a return of the “milkman” making home deliveries.

- Companies are rethinking the need for traditional offices, leading some to shrink their office space, consider permanent work-at-home arrangements and look to satellite offices in less expensive locations.

- Arthur, the first tropical storm of the season, is expected to graze the East Coast today.

- Confirmed COVID-19 cases in the U.S. are approaching 1.5 million and fatalities will soon surpass 90,000.

International

- While plastics converters in Europe pleaded for a postponement of the EU’s 2019 single-use plastics (SUP) directive, recyclers, buffeted by COVID-19 disruptions and low prices for virgin resins, are asking for financial relief.

- Latin America and the Caribbean have recorded more than a half-million COVID-19 cases.

- Brazil, experiencing record new COVID-19 cases last week, is without a public health leader following the resignation of its health minister without explanation after just four weeks in office.

- Russia’s confirmed cases surpassed the U.K.’s and Spain’s, giving the country the second highest infection rate behind the U.S.

- Japan reported its economy shrank 3.4% in the three months ended March 31, officially marking a recession with its second consecutive quarter of economic contraction.

- New COVID-19 cases prompted China to reimpose lockdown and travel restrictions and to quarantine 8,000 people in the country’s northeast.

Our Operations

- M. Holland Company has entered a distribution partnership with leading polyolefin producer Braskem to distribute a new line of innovative polypropylene filaments, powder and pellets for 3D printing.

- We distributed safety kits to our commercial teams this week for protection when making client and supplier visits when required.

- Our Color & Compounding team has introduced an expanded linecard of pulverized products for compounders.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- M. Holland is fully operational and prepared to meet client needs for materials, material selection, logistics services and technical support.

- We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.