COVID-19 Bulletin: May 8

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices headed higher in early trading today and appeared headed for a second consecutive weekly gain, with the WTI at $24.72/bbl and Brent at $30.39/bbl.

- U.S. drillers have idled 55 rigs a month since mid-March, with the active rig count falling to a record low 396 this week.

- A larger-than-expected increase in natural gas inventories led prices lower, stalling a recent recovery, with the futures price for June delivery down 2.6% to $1.894/MMBtu.

- The Treasury Department is considering extending tax benefits to the battered alternative energy industry, which accounts for 20% of U.S. electrical generation and has been largely ignored in COVID-19 rescue packages.

Supply Chain

- Facing a collapse in freight rates, independent truckers are accusing brokers of skirting regulations and asking Congress for greater regulatory transparency.

- A Distributor Pandemic Index maintained by Indian River Consulting Group registered a sixth consecutive week of double-digit revenue declines for industrial distributors, with sales down 19% in the week ended May 1 compared with the prior-year period.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

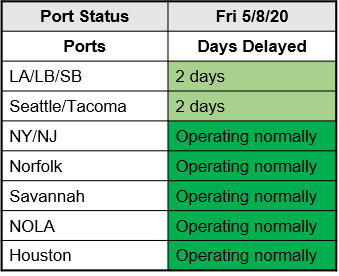

- U.S. ports continue to operate smoothly:

Markets

- The Labor Department reported that 20.5 million people lost jobs in April, a monthly record, with the unemployment rate at 14.7%.

- Minneapolis Federal Reserve Bank President Neel Kashkari says the official jobs report understates the unemployment level because many people are not looking for work during shutdowns, but he dismissed the prospect that the economy is headed for another depression.

- The Federal Reserve’s assets on its balance sheet rose to a record $6.7 trillion through yesterday, as the central bank continues to buy U.S. treasuries and mortgage-backed securities to support the financial system.

- State governments, which account for 11% of GDP and comprise almost as much employment as manufacturing and construction combined, are slashing budgets and payrolls in the face of ballooning deficits.

- A fourth rescue bill being prepared by the House of Representatives could contain up to $800 billion for local governments.

- With toilet paper and hand sanitizer back on store shelves, the latest products in short supply are disinfectant wipes, with Clorox reporting a 500% increase in demand and projecting supplies won’t catch up until summer.

- A rise in home alcohol consumption has not offset a decline in bar and restaurant sales, with AB InBev, the world’s largest brewer, reporting lower first-quarter revenue and a 32% drop in global volume in April.

- UnitedHealthcare and other major insurers are offering discounts, co-pay waivers and other assistance as a sharp drop in elective surgeries and healthcare visits to doctors is providing a windfall to health insurers.

- A report by The Government Accountability Office (GAO) says the U.S. Post Office, which accounts for 47% of global mail deliveries, is in peril without Congressional financial help. Meanwhile, the White House, which is resisting help for the U.S.P.S., named a new inspector general for the agency.

- Despite delays due to COVID-19, car companies are planning introductions of E.V. truck models, challenging the paradigm that the E.V. market will largely be comprised of small cars.

- Ohio is lifting stay-at-home mandates May 7, earlier than originally announced, while Michigan is reopening factories May 15.

- Most U.S. states are in some stage of reopening their economies.

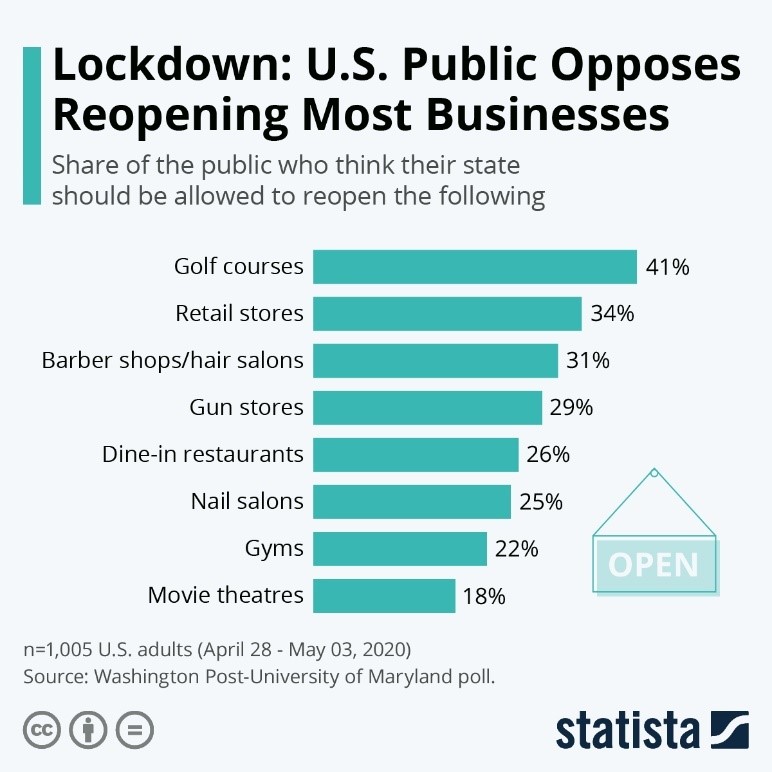

- Most Americans remain wary of a full reopening the U.S. economy:

International

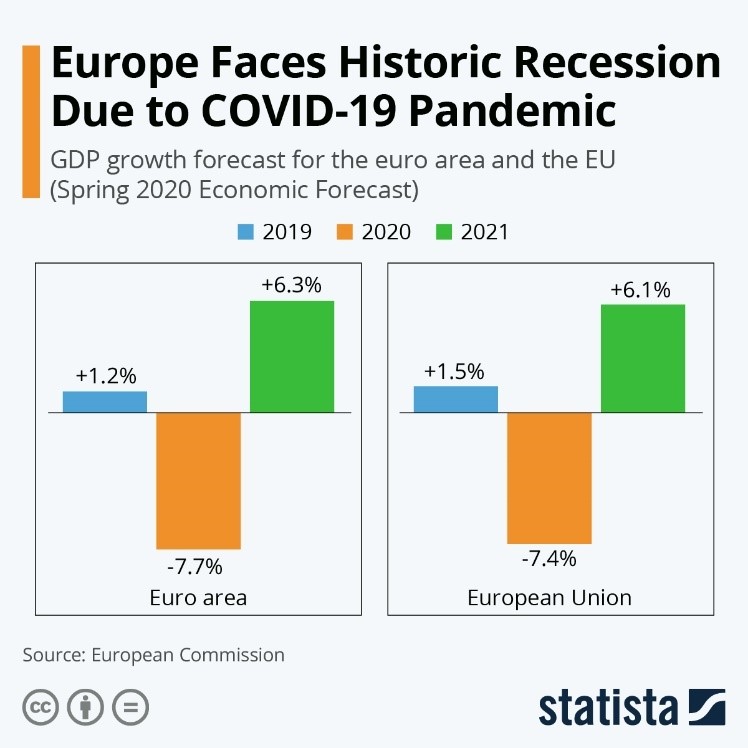

- The European Commission is predicting a deep recession this year followed by a steep recovery in 2021:

- Mexico City’s death rate from COVID-19 could be three times higher than the federal government is reporting.

- Sweden, which has drawn attention for not closing its economy in response to COVID-19, has experienced a 30% reduction in household consumption as wary citizens stay close to home. Meanwhile, the nation is experiencing the highest death rate and rate of childhood infections among Scandinavian countries.

Our Operations

- Our Healthcare team is offering video conferences for clients seeking advice on medical material selection, manufacturing and regulations. To schedule a meeting, contact Global Healthcare Market Manager Josh Blackmore.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- M. Holland is fully operational and prepared to meet client needs for materials, material selection, logistics services and technical support.

- We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.