COVID-19 Bulletin: April 27

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Volatility returned to oil markets today, with the WTI price down more than 25% in early trading at $12.47/bbl and Brent crude down more than 8% at $19.68/bbl.

- Daily ethanol production is at a record low while inventory is at an all-time high, adding to the woes of U.S. farmers already reeling from closures of meat packing plants and other turmoil in the agriculture sector.

- International ports are becoming parking lots for oil-laden vessels with little storage space available in the oversupplied industry.

Supply Chain

- China eased export controls on medical goods that have delayed deliveries of badly needed supplies internationally.

- Challenges posed by COVID-19 may prompt companies to reduce product offerings, simplify and localize their supply chains, and stock more inventory well after the health crisis.

- The severe cuts in air-freight capacity could interfere with a rapid economic recovery.

- U.S. packaging suppliers for export, hungry for business two weeks ago, now have backlogs as U.S. demand slows and some international regions emerge from lockdowns.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

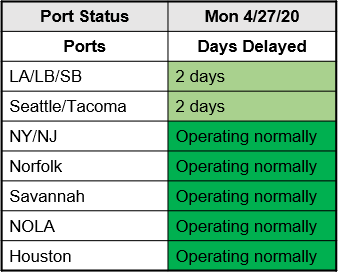

- U.S. ports continue to operate smoothly:

Markets

- U.S. durable goods orders fell 14.4% in March, with most of the drop attributable to the automotive and aircraft industries. Excluding the transportation sector, durable goods demand fell by a modest 0.2%.

- With last week’s passing of a fourth, $484 billion relief package, the federal deficit is expected to balloon to $3.7 trillion, with further economic aid expected.

- Sixteen states are in various stages of planning or implementing limited lifting of their stay-at-home restrictions.

- General Motors is suspending its dividend and stock repurchases in addition to other austerity measures.

- Tesla will return some employees to work next week to prepare for reopening its California plant in early May.

- More than a dozen public companies agreed to return funds they secured in the first round of Paycheck Protection Program (PPP) financing.

- The U.S. Treasury Secretary said the U.S. economy should recover beginning in July.

- Remote working is obliterating the 9-to-5 boundaries of the traditional workday and increasing both time at work and productivity.

- Conspiracy theorists in Europe have committed arson against scores of cellular towers on false rumors that 5G telecommunications technology causes COVID-19.

International

- Vietnam, which aggressively countered COVID-19, is reopening as among the strongest economies in the region.

- The market for credit insurance on international trade is under pressure, posing a further risk to a global economic recovery and leading some nations to support the industry.

- Italy, which imposed its lockdown on March 20, will begin easing restrictions on May 4.

Our Operations

- M. Holland is fully operational and prepared to meet client needs for materials, material selection, logistics services and technical support.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.