COVID-19 Bulletin: April 14

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- The WTI oil price closed yesterday at $22.41/bbl, down 1.5%, on concerns that the nearly 10-billion bbl/day production cut agreed to by oil-producing nations may not be enough to stabilize oil markets. Brent crude rose 0.8% to $31.74.

- Saudi Arabia slashed oil prices to Asia just days after agreeing to production cuts, signaling that stiff price competition will persist until inventories decline.

- Oil-services firm Baker Hughes will take a $1.8 billion restructuring charge and write down $15 billion in goodwill.

- Exxon raised $9.5 billion in bond offerings yesterday, just one month after tapping debt markets for $2 billion.

Supply Chain

- U.S. freight volume fell 9.2% in March compared with the prior-year period, with expectations of a bigger drop in April.

- Warehouse space is in high demand as supply chains reconsider JIT systems and consumers shun bricks-and-mortar stores in favor of online shopping.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

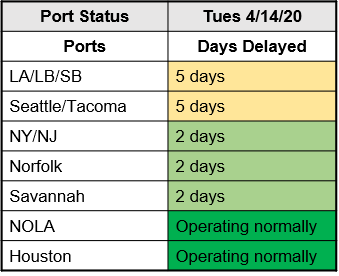

- There’s been no status change with ports:

Markets

- The International Monetary Fund (IMF) today predicted the global economy will shrink by 3% in 2020, making it the worst year since the Great Depression and dwarfing the 0.1% contraction of 2009. The IMF expects a rebound in 2021.

- Coalitions of governors on the East and West coasts agreed to coordinate the eventual reopening of their regional economies as growth in new COVID-19 cases in the U.S. slowed.

- Amazon is lifting its restriction on handling non-essential goods from third-party sellers after hiring 100,000 new employees with plans to add 75,000 more.

- Ford is forecasting a 16% revenue drop and a $600 million loss in the second quarter.

- Ford’s rapid conversion to face shield and ventilator production exemplifies how a crisis can stimulate innovation; we are working closely with Ford on raw material supply for the programs.

- Mazda Toyota Manufacturing will delay opening its new factory in Huntsville, Alabama, until “later” in 2021; two construction workers at the site tested positive for COVID-19 last week.

- Global logistics challenges led to a 12% drop in shipments of personal computers, despite high demand due to work- and learn-at-home restrictions.

- With the COVID-19 spread showing signs of slowing, attention is turning to how to restart the economy and the “new normal” that will emerge:

- Face masks, temperature checks and testing will become commonplace.

- The Wire Association International (WAI) sponsored a recent webinar on new procedures implemented by companies in China, Europe and the U.S. that are successfully operating in a COVID-19 environment.

International

- Some countries in Western Europe eased their lockdowns:

- Spain partially lifted restrictions on non-essential businesses, sending 300,000 people back to work. Bars, restaurants and some other non-essential businesses will remain closed.

- Austria and Italy allowed some non-essential businesses to open.

- India extended its lockdown until May 3.

- Polyolefin prices rose in China from decade lows on rising demand for fiber, packaging and medical supplies and an aggressive schedule of pending maintenance shutdowns.

Our Operations

- M. Holland is open for business, deemed essential and will continue to operate at full capacity. We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.