COVID-19 Bulletin: April 1

Good Afternoon,

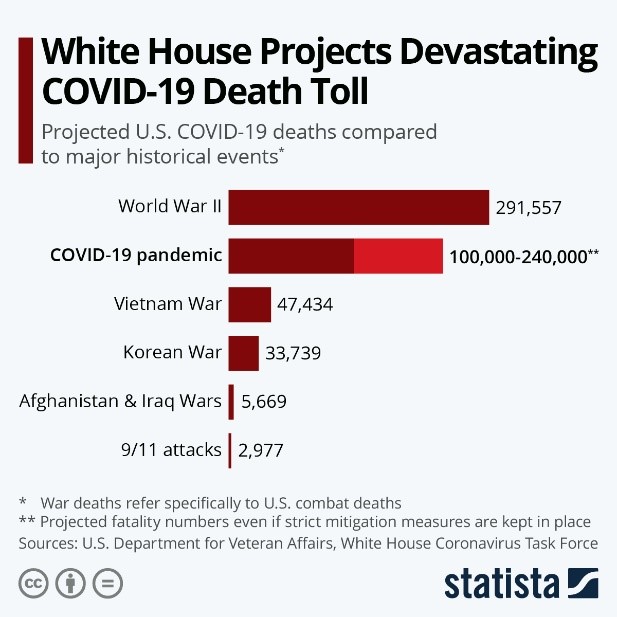

The COVID-19 crisis has deepened, with the federal government estimating U.S. deaths could range from 100,000 to 240,000. Here’s more COVID-19 news relevant to the plastics industry:

Supply

- U.S. crude futures rose 1.9% Monday to $20.48/bbl., down 54% in the month of March and 66% in the quarter.

- Gasoline prices dipped below $1 a gallon in some parts of the country.

- Oil markets have crossed steeply into “contango” territory, when futures prices are significantly higher than spot prices.

- BP will take a $1 billion write down and cut capital spending by 25%, including a $1 billion reduction in shale spending.

Supply Chain

- Our Gold Standard logistics partners continue to provide uninterrupted service.

- We are closely watching railcar availability as export demand softens, potentially leaving resin inventory stranded in railcars.

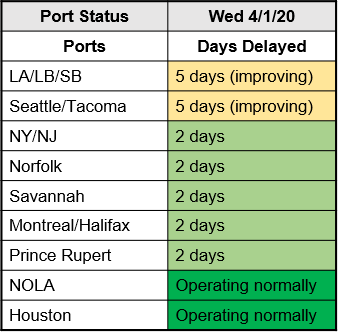

- We’ve seen some improvement in the status of ports:

Markets

- COVID-19 could result in more U.S. fatalities than all wars since WWII combined:

- The Dow yesterday closed its worst quarter in history, down 23%; the S&P suffered a quarterly drop of 20%, its worst quarter since 2008.

- Consumer confidence fell sharply in March to the lowest level since June 2007.

- At least 30 states comprising more than 75% of the U.S. population have imposed stay-at-home restrictions.

- Demand for face masks, already in short supply, could surge further if the CDC adds wearing face masks to its public health recommendations, as it is now considering.

- The Federal Reserve announced an unprecedented program to provide short-term lending to other central banks to ease liquidity pressures in the global financial system.

- Goldman Sachs revised its estimates for second quarter economic growth downward, now expecting a contraction of 34% from first-quarter GDP. Unemployment in the second quarter is now expected to top 15%.

- M&A activity has ground to a halt as companies and investors preserve cash.

- There could be a wave of demand for serology testing (blood testing) to identify recovered COVID-19 victims with immunity who can safely provide healthcare support.

- We have seen some manufacturers restricting shipments to essential items only in order to scale back production to protect employees.

- 3D printing continues to help fill the void in protective gear availability.

International

- The ASEAN Purchasing Managers Index plunged to an all-time low.

Our Operations

- NOTICE TO CLIENTS: M. Holland Company will be closed on Good Friday, April 10.

- March orders were healthy and the highest monthly order intake of the past six months of our fiscal year.

- Our on-time delivery performance to date has not been affected by COVID-19.

- Ed Holland sent a message to Mployees highlighting some “silver linings … in an otherwise gloomy news cycle.”

- M. Holland is open for business, deemed essential and will continue to operate at full capacity. We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.